Quick Look: Ethos Life Insurance

If you’re curious about Ethos and how their life insurance works, this guide helps you understand your options. Many people wonder: “Is Ethos legitimate? Can I get coverage quickly?” The short answer is: Yes — within a specific lane.

Ethos is a licensed, publicly traded company on the NASDAQ stock exchange. They work with multiple independent life insurance companies and offer a platform designed for fast, no-exam coverage. Their automated system is fair and unbiased for the products they offer. Learn more about their process here.

Path A: Work With a Professional Broker

Best for people who want professional guidance, flexibility, and long-term value.

- Full guidance and coverage tailored to your budget and goals.

- Access to multiple carriers, policy types, and optional living benefits.

- Coverage optimized for value, flexibility, and important add-ons.

This route opens doors Ethos can’t — especially for shoppers who want options beyond no-exam coverage.

Path B: Use Ethos’ Automated Platform

Best for speed, privacy, and simplicity.

- Designed for speed, simplicity, and convenience.

- Mostly instant-issue, no-exam policies (~10% require extra review) — learn about no-exam options.

- Ideal for those who prefer a self-guided, private process.

Bottom Line: Ethos is legitimate and convenient. You can choose: Path A for full guidance and maximum value, or Path B for speed, privacy and simplicity. If you go down “Path B,” first-time applicants will benefit from our pre-application guide to guide and smooth the process.

How Ethos Life Insurance Works

Ethos guides applicants through coverage without medical exams. Most applications are processed instantly — about 90% of applicants get immediate decisions. Roughly 10% may require additional review, but coverage is issued once the process is complete.

The platform is ideal for applicants prioritizing speed, simplicity, and mostly instant coverage, but some advanced options (like living benefits) are only available through a broker.

Ethos Insurance Partners & Proprietary Products

Ethos itself is not the insurer — it’s a platform connecting you directly with reputable carriers. Ethos partners with Banner Life, Protective, North American, TruStage Financial, and Ameritas Life Insurance Corp. to offer coverage. These are all very reputable life insurance companies.

The insurers all use proprietary products designed specifically to work with Ethos’ automated, fast-issue platform. Traditional, flagship products from these carriers are not available through Ethos, as the underwriting processes require a licensed broker and additional time to be assessed and approved. This is one of the platform’s limitations compared to working with a professional advisor who can provide full-market access and more customization.

Ethos uses an automated platform to quickly assess applications, which works well for straightforward health cases. You can also explore Ethos plans directly at Ethos.com to see what policies you may qualify for without talking to anyone.

Pros & Cons of Ethos

✅ Pros

- Fast, fully online process

- No medical exam required

- Policies issued by reputable carriers

- Broad eligibility and coverage

- Helpful extras — estate planning tools, 30-day money-back guarantee

- High customer satisfaction reported

❌ Cons

- Limited customization and fewer riders than a broker can provide

- Restricted product shelf — not all carriers or policies available

- Potentially higher rates for some applicants

- Not available in all states (e.g., New York)

- Some customer service limitations

Making the Right Choice: Broker or Ethos

Path A: Work With a Broker

- Access a wider range of carriers and policy types.

- Add living benefits, policy conversion privileges, and other riders.

- Receive personalized guidance for health, underwriting, and long-term planning.

- Ensure your policy delivers real-world value.

- Ongoing support from policy issuance through claims.

- Explore your best-fit policies with a quick consultation.

Path B: Use Ethos

- Fast, convenient, private no-exam solution.

- Your personal information is securely handled without human judgment.

- Streamlined application and quotes from a limited set of carriers.

- Great for speed and simplicity but less customization than a broker.

- Realistically, it works best for people who value convenience over tailored advice.

Why Working With a Broker Can Be Smarter

- Access to more carriers and policy types

- Customized coverage and riders

- Better value per dollar

- Personalized guidance

- Ongoing support

💡 Why Policy Persistency Matters

One key difference between working with a licensed broker and using an online platform like Ethos is policy persistency. Policies obtained without professional guidance often lapse early — sometimes 20–40% of the time — leaving coverage gaps or making future coverage more expensive.

With an experienced broker, you get guidance to choose the right policy, understand long-term commitments, and avoid lapses that could jeopardize your coverage. Staying committed ensures your family is protected, your investment is preserved, and you maintain access to the coverage you need when life changes.

Speak with a broker today to make sure your policy works long-term for you and your loved ones.

Reality Check: Privacy Doesn’t Mean No Verification

Even with a private platform like Ethos, verification is mandatory. Life insurance is regulated, and your identity, health, and personal data must be confirmed.

- Social Security number, date of birth, name, and address must be verified — learn why here.

- Health and lifestyle questions are standard for accurate underwriting.

It is a red flag if you are not asked to confirm identity. If you are applying for a first day full coverage policy, you will be asked health questions and for permission to verify that information is accurate, electronically. Without that information, no insurer will be able to issue term or any full first day coverage policy. This includes all life insurance companies not just what Ethos offers.

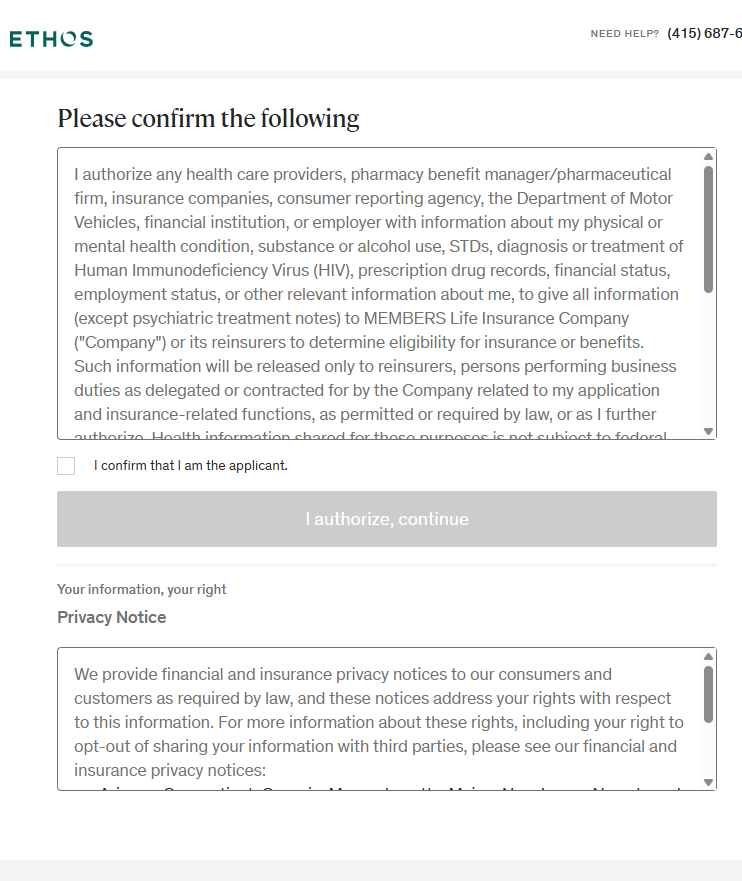

To move forward with an application for processing, you would be required agree to allow the instant electronic checks.

Why? Insurance companies have to verify if the applicant qualifies for the coverage. They are not ordering doctor records or a paramedical exam with labs.

Below is an example of what is part of an application for legit life insurance policy except guaranteed issue whole life insurance. That product is discussed later in this Ethos insurance review.

The Important Part Most People Miss

Every policy has rules and limitations. Working with Maple Valley Insurance Group helps you get the right policy for your goals, often more affordably and with better coverage than an automated solution alone.

Whole Life vs. Term: What to Expect

Term life is ideal for healthy applicants seeking straightforward coverage. Whole life accepts a wider range of health profiles. Ethos primarily offers term and no-exam coverage; if your health doesn’t fit their instant-approval criteria, you may be guided toward traditional underwriting or alternate coverage options.

Pick a Lane — But Pick One

You’re at a crossroads. Work with a trusted advisor for full-market access and personalized guidance, or handle everything online with Ethos. Both paths work — knowing your options helps you decide.

Waiting too long can cost more. Acting sooner locks in better rates and peace of mind.

Option A: Talk with an advisor. A short form pops up right here — nothing is visible until you click.

Option B: Prefer online? Apply with Ethos. Click “Check My Price” to see rates for policies you may qualify for. Coverage can start immediately — no obligation to speak with anyone.

💡 Pro Tip: Need guidance first? Check our Pre-Application Guide to make the process smoother.

What Happens If You Don’t Qualify for Ethos Term Life Insurance?

Not everyone will qualify for term insurance. If your health or profile doesn’t meet the standard criteria, your options narrow:

- Rated or modified term policies: You may still get coverage, but premiums could be higher.

- Whole life or final expense options: Easier to qualify for, but coverage is smaller and typically costs more.

- Guaranteed issue whole life: Limited benefits, higher costs, and a two-year waiting period before full benefits apply. Only necessary if no other options are available.

Important Note About Term Life Insurance for Seniors

Term life insurance is designed for a defined period of time, usually while you’re still working and protecting your income as a breadwinner or the raising the children. Policies generally don’t provide coverage past age 80, so if you’re in your 60s or older, qualifying can be very difficult due to age and health. Term life isn’t intended for retirees, final expense planning, or those on disability—if that’s your situation, whole life policies are typically the better fit. If you’re unsure which option is right for you, give our office a call at 269-244-3420 for guidance and personalized assistance.

Takeaway: Knowing your alternatives in advance lets you plan. A licensed advisor can help identify the most affordable and realistic options for your health profile.

How Ethos Whole Life Insurance Supports Final Expense Planning

Ethos whole life policies provide practical financial protection for end-of-life expenses. They are designed to be:

- Permanent

- Predictable

- Easier to qualify for than term life

- Premiums locked for life

- Benefits never decrease

These policies can help pay for funeral costs, medical bills, lost income, or leave a financial gift for loved ones. They are not intended for large coverage needs but do offer a reliable option if term life isn’t available.

The Two Whole Life Options You May See

Simplified Issue (Level Benefit) Whole Life

- Limited health questions

- No medical exam

- Immediate full death benefit if approved for the policy

- Smaller face amounts

- More affordable whole life option

Guaranteed Issue Whole Life (High Risk Life Insurance)

- No health questions or exams

- Two-year limited benefits for natural causes

- Accidental death covered immediately

- More expensive than other whole life insurance policies

Only use guaranteed issue if no other policy is available. It comes with higher costs and limitations. If this is your only option, call us at 269-244-3420 — we can often help you secure a better policy.

Important Notes About Ethos Application Process

Ethos evaluates eligibility in stages:

- Term life insurance

- Simplified issue whole life

- Guaranteed issue whole life

This ensures the best option is offered first. Keep in mind, Ethos only has access to certain products — it cannot provide the full market or all carrier options that an independent agent can.

Should You Use Ethos

Ethos Life Insurance is ideal for generally healthy applicants who want a fast, no-exam application. It offers convenience, but does not provide the same choices across carriers or the personalized guidance a licensed independent agent can give.

Key limitations to be aware of:

- Carrier limitations: Fewer carriers than the full market — better rates may exist elsewhere.

- Health underwriting: Limited for applicants with pre-existing conditions; rates may be higher.

- Coverage flexibility: Term lengths, riders, and benefit options are restricted compared to independent agents.

For seniors, especially with health concerns, working with a licensed agent is smarter. You can quickly view Ethos options, but for personalized guidance and access to dozens of carriers, talk to a licensed independent advisor.

Your Options

Option 1: Work with a Licensed Broker

If you want personalized guidance, full access to the market, and the best possible outcome for your health profile, we’re here to help. Our independent advisors navigate dozens of carriers, including instant approval and guaranteed acceptance options, to find the product that best fits your needs — at no extra cost to you.

Option 2: Apply Online with Ethos

If convenience, privacy, and speed are your priority, you can apply online and receive coverage immediately. The process is straightforward and fast.

Both options are valid. The right choice depends on your goals, health, and comfort level.

Real Talk: Is Ethos Life Insurance Legitimate?

Ethos deserves credit for innovating life insurance. Their platform delivers instant term insurance and final expense insurance including guaranteed-issue whole life options that don’t require perfect health. Their approach makes quick, painless coverage accessible for people who prefer a fully online process.

Does Ethos pay life insurance claims? Not in the way some might think. Ethos is not the insurer. They are a technology platform that places your policy with a reputable insurance company during the application process. You might say it is “direct to consumer” insurance. The policy names might include “Ethos Term Life,” “TruStage Advantage Whole Life,” or another, depending on the carrier. However, the insurance company, partnered with Ethos and issued you coverage, is the one that pays the claim.

Automated underwriting comes with trade-offs: limited products, higher costs since there is no paramedical exam nor the standard review of medical records from your physician. As a result, the insurer doesn’t know you as well as a traditional policyowner, which creates risk from the company’s perspective. Do your part by answering honestly and paying premiums timely, and your coverage is guaranteed according to the policy terms. Enough said.

Are There Any Ethos Life Insurance Complaints?

Yes — and most of them have nothing to do with Ethos “failing” and everything to do with misunderstood expectations. Plenty of Ethos life insurance reviews from consumers expecting no health questions or verifications to be done. Unfortunately, it would not be an insurance policy without the requirements being met. Viewing our guide on what you should expect from any automated life insurance platform will fill you in on why and what to expect.

Most of the “complaints” come from people discovering a hard truth:

life insurance doesn’t work on what you want — it works on what you qualify for.

Some applicants are frustrated when term life coverage is not offered. That’s not an Ethos error — that’s how term life underwriting works everywhere. It is harder to qualify for. For example, a senior in their mid-70s wanting for a 20-year term policy will be disappointed — because 20 yr term life insurance simply isn’t designed for that age group. This is another reason why Ethos offers alternatives for those who can’t qualify for a term life insurance.

Ethos uses technology to guide applicants through this process quickly and efficiently. When term coverage isn’t available, it often presents alternatives like whole life coverage. That’s not bait-and-switch — that’s how underwriting works. The system is trying to solve a problem that would otherwise result in a decline which is not a “postive” to have on your MIB (Medical Information Bureau) record.

In many cases, Ethos will present alternative options, such as whole life coverage. That’s a normal next step when term life isn’t available to an individual.

Other complaints come from shoppers looking for the absolute lowest price or specialized features like term policies with living benefits. Those options simply aren’t part of Ethos’ current model. The platform focuses on speed, automation, privacy and a narrower product lineup. When your needs align with that design, Ethos can be a clean, efficient solution.

If Ethos presents a guaranteed-issue offer through a carrier like TruStage, that’s a signal — not a destination. Guaranteed-issue policies exist to solve very specific, high-risk situations. If your original goal was income replacement or family protection, it’s worth slowing down and getting a second opinion before accepting that type of coverage.

That’s where independent brokers excel.

Online platforms — whether Ethos or direct-to-consumer insurer sites — are inherently limited. An experienced independent broker provides access to the full market, strategic product matching, and underwriting guidance that often leads to better coverage and lower cost, especially for applicants with health concerns amoung other high risk scenarios. There’s no added fee for that expertise.

Ultimately, it comes down to priorities:

speed, privacy and convenience versus strategy, flexibility, and optimization.

Maple Valley Insurance Group helps clients evaluate both paths and choose the one that actually fits their goals — not just the one that’s fastest to click through.

One last reality check: researching for days doesn’t lock in your insurability. Taking action does. Age and health only move in one direction. If life insurance is on your radar, the best time to secure it is before it becomes harder and more expensive to do so.

Closing Our Ethos Insurance Review

So, what’s the final verdict — is Ethos life insurance good?

Ethos is a real legit company, with real policies, and for the right person, it can be a convenient way to get coverage quickly.

But being “good” and optimal for most people are two very different things.

Ethos is a tool. And like any tool, it works best in narrow situations — primarily for people who are comfortable being fully self-guided, answering health questions without interpretation, and accepting the results without advocacy or adjustment. If speed and convenience matter more to you than customization or long-term optimization, an automated platform like Ethos may feel like a good fit.

Where technology falls short is where real life gets complicated.

Life insurance is rarely just about checking boxes. Health histories are nuanced. Financial priorities change. Products that look similar on the surface can perform very differently over time. And when underwriting questions, rate adjustments, or policy structuring issues arise, an algorithm doesn’t explain your options — it simply renders a decision.

That’s where experience matters.

A seasoned independent broker doesn’t just submit applications. They translate medical histories, anticipate underwriting outcomes, compare carriers that never appear on direct-to-consumer platforms, and help people avoid policies that look fine today but cause regret years down the road. That perspective comes from decades of seeing and hearing what works — and what fails — for real families.

No automated platform can replicate that level of judgment, advocacy, or personalization. And it likely never will.

That said, not everyone wants that relationship. Some people prefer minimal interaction, fewer questions, and a faster, fully online process — even if that means fewer options and less guidance. For those individuals, Ethos can serve a good purpose.

Ultimately, the choice comes down to how you want to buy life insurance:

- Guided, with a professional who understands the full market and helps you get the most value for your dollar

- Or self-directed, using an automated platform that prioritizes speed and simplicity

Both paths can lead to coverage. Only one prioritizes strategy.

If you’re ready to act, the most important thing isn’t which platform you choose — it’s that you choose something. Waiting doesn’t protect your family. Taking informed action does.

FAQ About Ethos

Is Ethos a real insurance company?

Not exactly. Ethos is an automated, licensed life insurance agency that helps consumers apply for coverage from partnered insurance carriers. Those carriers — not Ethos — issue the policies, assume the risk, and pay claims. You can see your options instantly online or work with a licensed agent to compare multiple carriers.

Can I get Ethos coverage if I have pre-existing health conditions?

Yes. Ethos offers policies, including guaranteed-issue options, for applicants who may not qualify with one of their other partnered carriers. These policies provide coverage quickly, but full benefits for natural causes of death only start after a two-year waiting period. Guaranteed-issue policies are typically more expensive and have lower coverage limits. A licensed independent agent can help explore all available options and potentially find lower rates. Request a personalized quote.

Do I have to talk to anyone to get insured?

Ethos lets you complete the process online — no phone calls needed. You can get started instantly. Many people still prefer working with a licensed independent agent to ensure the best coverage for their needs and health.

Is Ethos coverage more expensive than other options?

Ethos prioritizes fast, automated approval, which may cost more than products available through full market access. Independent agents can compare numerous carriers and policies to find better pricing. Pricing differences usually come down to underwriting flexibility and carrier access. Get a free quick comparison quote.

What is guaranteed issue life insurance?

Guaranteed-issue policies require no medical exam or health questions. Ethos offers this for applicants who may not qualify with one of their other partnered carriers. While convenient, accidental death coverage is immediate, but full benefits for natural causes of death only start after a two-year waiting period. Guaranteed-issue policies are typically more expensive and have lower coverage limits. Learn more with a personalized agent quote from Maple Valley IG or read more about guaranteed-issue policies.

What is Ethos guaranteed issue life insurance?

Ethos currently offers a guaranteed-issue whole life policy designed for applicants who may not qualify for standard underwriting. This policy is issued by TruStage Insurance Company, a long-established and financially solid life insurance provider operating nationwide. There are no health questions and no medical exams. Accidental death coverage is immediate, while natural-cause benefits have a two-year graded period. Guaranteed-issue policies are convenient but usually more expensive than medically underwritten options. Compare guaranteed-issue plans from multiple carriers with a personalized agent quote.

Should I use Ethos or talk to an independent agent?

If you want speed and convenience, Ethos is fast and has online 24/7 processing. If you want full-market access, better pricing, and personalized guidance, a licensed agent like Maple Valley Insurance Group is recommended. You can start with an agent quote or get instant Ethos coverage.

Can I switch from Ethos to another policy later?

It depends on your situation. For most people, switching a simple term life policy after a few years isn’t cost-effective — premiums can be significantly higher as you age. Changes in health, quitting smoking, or needing a policy with added benefits may make switching worthwhile. Otherwise, delaying or swapping policies often doesn’t improve your position and can actually be a financial setback. A licensed agent can help evaluate your options before making a change.

Is Ethos good life insurance?

Ethos can be good life insurance for the right person — typically healthy term life applicants or seniors purchasing final expense insurance who want speed and convenience. Coverage is issued by reputable, financially strong carriers, and pricing can be fairly competitive. However, people with complex medical histories or specialized needs may benefit more from working with an independent agent or broker who can compare multiple carriers and policy options.

Why choose Ethos over an independent agent?

Ethos offers a fast, fully online application process with instant approval decisions for many applicants, which is convenient for people who want to secure coverage quickly. However, independent agents can access a wider range of carriers and policies, potentially offering better pricing, underwriting flexibility, and personalized guidance. Choosing between Ethos and an agent depends on whether speed or full-market access is your priority. Compare options with a licensed agent.

Whether you already have coverage or are just researching, we can help you compare plans and explore your options across multiple carriers. Make sure you’re getting the coverage that truly fits your needs.