Many of us saw the Alex Trebek life insurance commercial more than a few times over the years. Are you curious if he was recommending a good policy or not? In our review, we’ll help you decide and also provide our own professional opinion.

As the host of Jeopardy for many years, plenty of consumers saw Mr. Trebek as someone who was very articulate and familiar to them.

While that all sounds nice, it is important to remember that Mr. Trebek was not a life insurance expert, but a paid spokesman for Colonial Penn Life Insurance Company. He passed away in November of 2020 and has been replaced by Colonial Penn employee, Jonathan Lawson as the actor in their commercials.

What kind of life insurance did Alex Trebek advertise for them? Well, in a nutshell, it was whole life insurance. However, you should understand there are different kinds of whole life insurance.

Before we get to far, the insurance Alex Trebek endorsed is underwritten and sold by Colonial Penn Life Insurance Company. If you are searching for Colonial Life insurance for seniors, you may be looking for a local agency versus the insurance company that paid for Mr. Trebek’s services.

With that said, let’s continue on and review the Alex Trebek life insurance policy from Colonial Penn. By the end, you will know what you may be getting yourself into if you purchase their Guaranteed Acceptance insurance plan. We’ll also give you the insight on how to get better coverage and at a lower price as well.

Guaranteed Issue Life Insurance Caveats

Colonial Penn marketing states: “Your acceptance is guaranteed!”

Sounds pretty good, right?

Life insurance consumers need to proceed with caution with this particular type of whole life insurance.

Why?

It is less than ideal for the typical age 50-85 consumer.

Now called the 995 Colonial Penn Guaranteed Acceptance insurance plan, it does have some major limitations in it.

Because it affects not only the policyowner but their loved ones…don’t be surprised if I bring the heat later in this post.

With that said let’s continue…

FYI, I talk to numerous life insurance consumers age 40-90 in a week. Most callers are shocked when I explain why they don’t want to own a policy like this unless they have no better life insurance alternatives.

What has been apparent, consumers do not realize the actual cost and the contract limitations of a guaranteed issue policy.

A key point to remember, Alex Trebek, was a well compensated endorser of their policy. His job was to promote the Colonial Penn name. Most insurance companies do not hire celebrities to market their products.

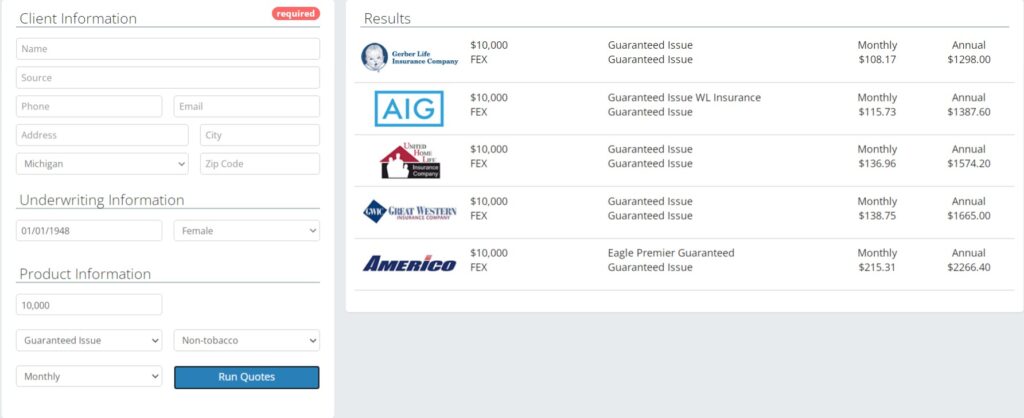

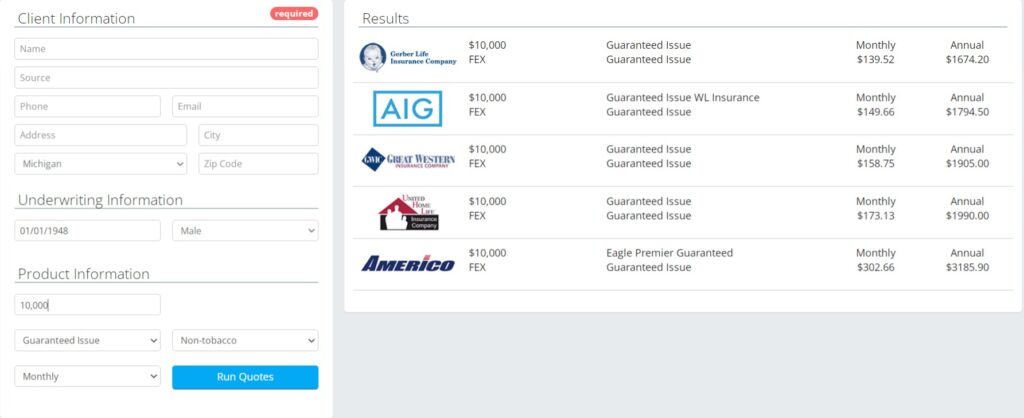

Before I get into the meat of this post, it is advised to use our instant, final expense quoting tool on this page. This instant quoting widget will help you know what the competition is charging for no medical exam, whole life insurance. Simply judge your health compared to your peers (Excellent, Decent, Poor) and less than a minute you will know what all the top life insurance companies will charge compared to the policy endorsed by the late Mr. Trebek. With that said, select “poor health” only if you want to see companies who offer guaranteed acceptance policies like the 9.95 life insurance plan from Colonial Penn.

Colonial Penn And The Alex Trebek Insurance Commerical

Colonial Penn is a life and health insurance company located in Philadelphia, Pennsylvania. They offer life insurance and Medicare Supplement insurance for seniors.

The company has a history of hiring celebrities to endorse their life insurance. Many of us know Ed McMahon, Joe Theismann and even Jerry Lewis. They were all paid endorsers.

A lot of people, young to old have seen the Alex Trebek life insurance commercial.

The focus of these advertisements was to promote a whole life insurance policy that offers guaranteed acceptance, and a “rate lock,” premiums that will never go up and a death benefit which will never go down.

“Colonial Penn Guaranteed Acceptance Whole Life” is nothing unique. It is simply a high risk life insurance policy. There are a few different life insurance companies offering it. Colonial Penn is only one of them.

What does Guaranteed Issue mean exactly?

Well, it does not ask any health history questions life like other no medical exam policies.

That sounds pretty good right? Nice and easy.

The reality…

You will pay a hefty premium for “no health questions.” On the back end it could punish your family dearly if you pass away in the first 2 years from natural causes.

Understand that life insurance companies cannot clearly evaluate the risk level of a person accurately without asking health history questions. Life insurance is all about the perceived risk they have in insuring someone. What do you think they do in to offset the risk of not having a clear picture of whom is requesting life or burial insurance protection from them?

You got it. They jack those rates up for starters.

And…

They also insert a limited benefit period for natural death causes into the policy.

For those of you shocked by hearing this…

Here is what you need to understand about the whole life insurance plan Alex Trebek endorsed…

For the first 2 years of coverage with Colonial Penn guaranteed acceptance whole life insurance, “there is a limited death benefit for natural causes of death.” For example: cancer, stroke, heart attack. During the first 2 years, your loved ones would receive all your premiums plus interest as the benefit amount if you pass away due to natural causes.

Interest on this policy as of 2024 is 7% which is lower than most other carriers who offer Guaranteed Acceptance whole life insurance. The interest rate is locked into the policy. It is NOT variable. 10% is the common rate from the few other insurance comanies who offer “guaranteed acceptance” whole life.

So…

Throw out the fancy celebrity glitz and take a real look at what Colonial Penn is trying to sell you.

Guaranteed Acceptance Whole Life Insurance From Colonial Penn

The trivia game show host motivated many, many seniors to consider Colonial Penn in his time as paid spokesman. What he did not reveal are the real reasons to avoid guaranteed acceptance policies unless they are advised by a licensed life insurance expert. That is a problem itself. Roughly 90% of people 50-85 can obtain a better whole life policy with a lower premium and better benefits. At our office, only 10% of our callers need to pay and accept the limitations built into guaranteed acceptance whole life insurance.

The odds you are in that 90%. Have you spoken with a seasoned life insurance professional regarding the options you have?

Later in this article, I will explain the limited use of these no health question policies.

I’d like to suggest that life insurance is more complicated than the TV makes it out to be. Ultimately, it is what is written in the contract, the policy itself that matters. The insurance company’s name does not mean it is a “good policy.”

Take a paid endorser that does not have insurance expertise with a grain of salt.

Use our free tool on this page, select “Poor” under the “Health Classification” and you will see the best pricing from life insurers who offer the same type of protection. We generally advise people to use Gerber or AIG IF they need high risk life insurance like the Alex Trebek Life Insurance product. Be prepared to be shocked!

Because these insurance products ask no medical questions during application, it is known as “guaranteed acceptance” whole life insurance. Again, this type of life insurance is available from a few different life insurance companies and not proprietary to Colonial Penn.

It is a pure, high risk life insurance product for those who cannot qualify for better and more affordable whole life insurance coverage. For example, someone who may have a terminal illness, later stage internal cancer, on kidney dialysis, needing an organ transplant or have Alzheimers or Dementia.

These situations do require guaranteed issue life insurance. There is no way around it.

So What Was The Alex Trebek Life Insurance Commerical About?

Colonial Penn Life Insurance used to offer 2 different whole life policies. Both were marketed aggressively to senior citizens.

The Guaranteed Acceptance Whole Life Insurance Alex Trebek promoted is a policy with critical caveats.

It is important you understand this clearly before ever purchasing any guaranteed issue life insurance.

Why?

Because this could end poorly for your loved ones if you pass away unexpectedly.

No medical exams, no health questions. Your acceptance: guaranteed.

The above quote was taken directly from colonialpenn.com in 2019.

While Colonial Penn offers one other life insurance product, the guaranteed acceptance whole life insurance is what most seniors are curious about.

If you are looking to cover the cost of funeral, you’re out of luck paying $9.95 a month. It’s good you are reading reviews like this that show you the real monthly cost of a burial policy with this carrier.

If you are wondering if the price per month was not accurate, you were just not aware of how the insurance company was pricing this particular life insurance program. We will get to that specifically later in the article.

Ed McMahon used to advertise $6.95 per unit for Colonial Penn’s (Conseco Direct Life) Guaranteed Acceptance plan. The Alex Trebek commercial for life insurance comes in at $9.95 per unit. Same product folks just rebranded a couple of times.

Funerals have gone up in price over the years. I can tell you that in the late 90’s, the average, burial policy I sold was about $7000 of coverage. No consumer at that time got a burial policy for $9.95 for $7000 of coverage either. As of January 2024, our callers are regularly requesting burial insurance that exceeds $15K to cover their funeral and burial.

If you want to leave a significant death benefit for your loved ones, $9.95 per month in premium isn’t going to help out very much. That is a very, very small policy if you are planning for final expenses. Buy additional units unless you need a very small policy.

Alex Trebek Life Insurance For Seniors

There are no shortage of reviews on whole life insurance offered by Colonial Penn. Their most popular life insurance plan is their own guaranteed acceptance whole life. This is for 2 reasons. Number one, a high paid celebrity telling you how wonderful it is and second that it offers guaranteed acceptance.

For $9.95 a month, you can purchase one “unit” of the Colonial Penn Life Insurance Guaranteed Acceptance policy, mentioned in the Alex Trebek insurance commerical.

How Much Coverage Does The 9.95 Plan Give You?

Aah, good mystery to have an answer to.

Answer: It depends upon your age at application and whether the insured individual is a man or woman.

This is a real problem with Colonial Penn 9.95 “units.”

The unit price sounds quite enticing but…

One unit does not buy enough insurance to cover the cost of a cremation let alone a full funeral for a 70 year old senior

Since you are buying units with Alex Trebek life insurance, the more units you purchase the larger the value of your policy.

However, you need to know the true value of the units. This is variable and VERY important to understand.

Stay with me here and read on. I will elaborate on “units” and what to expect.

Units are not typical in the life insurance business. While I personally don’t agree with “units”, it remains a state approved method of marketing the insurance to consumers otherwise Colonial Penn would be unable to run commericals for their guaranteed acceptance life insurance let alone sell it to you.

How many can you buy?

As of January 2023 consumers age 50-85 are allowed to buy up to 15 units. Therefore, the maximum anyone would pay would be (15 X $9.95) or $149.25 per month.

Now some folks look at that and say, sounds like a “fair” price.

Not really. There is another catch here with the Alex Trebek 9.95 life insurance product and we still don’t know what that translates into in terms of the death benefit to your loved ones.

If you have not already, run a quote on the final expense quote tool on this page. See what size policy that $149.25 per month will buy. Take a look at the competition out there. Be prepared to be shocked!! Yes, you will receive quotes for whole life insurance.

Now check out the Colonial Penn rate chart below which shows how much coverage each unit is worth in 2023. Notice the difference between Male and Female as well as your current age.

The Colonial Penn life insurance for seniors that Alex Trebek advertised will be best suited for those folks who are closer to 50 and in very poor health.

As mentioned earlier, you are buying a unit of insurance, not a death benefit amount. The actual death benefit is independent of the number of units you purchase. You will see this illustrated later in this article.

With the Alex Trebek, Guaranteed Acceptance insurance ad, the older you are, the less insurance coverage you receive for each $9.95 unit you buy.

So a 75 year old is going to be penalized regardless of good health versus a 65 year old who may have congestive heart failure and lung cancer. With the Colonial Penn Guaranteed Acceptance plan, the value of the “units” depends strictly on your age at purchase, not your overall health history. At 65, the policy value of each $9.95 unit is much higher which translates into more death benefits than the than the healthy individual. In fact, there is no way for a good health 75 year old to obtain the same amount of financial coverage if both purchased the maximum number of units with this particular policy.

The value of the units for the insured applicant is determined at application for the policy. This determination will translate to the death benefit the policy beneficary will be paid according to the terms written into the guaranteed acceptance policy. The value determined will be locked going forward for as long as the premium payment is remitted to Colonial Penn.

In real life, “units” can pose a major problem for families being underinsured thereby imposing major financial troubles for those they are trying to protect.

And…

Don’t forget, the first two years are return of premiums plus interest for death due to natural causes.

What to understand about Colonial Penn $9.95 Life Insurance units…

The minimum value of one “unit” is currently $418 while the maximum is $2000. That is why the maximum policy value is $30,000 if you are young enough at application. Again, it depends on the value of each “unit” at application. If you are age 80 at purchase, the value of 1 unit is very low compared to age 50. Take a look at the Colonial Penn life insurance rates for this product in the tables below for specifics. We have provided rates by gender and age.

For many seniors, the guaranteed acceptance whole life insurance advertised by Alex Trebek will not provide enough funding for a simple funeral in 2024 and beyond.

What you need to remember about the Guaranteed Acceptance program: it is for high risk life insurance applicants.

They don’t tell you that do they?

Just because you are a senior does not mean that you are one of these candidates. In fact, here at our agency, roughly 85-90% of seniors are not!

Yes, the other 10-15% of seniors life insurance policy holders have some very serious medical issues which may impair their ability to medically qualify for immediate benefit, no exam whole life insurance. Medically underwritten, no exam whole life is superior protection for your family, is more affordable and does not have the limitations written into the whole life policy as a guaranteed issue policy does.

Keep in mind, people age 40-85 are the vast majority of our clientele at Maple Valley Insurance Group. We are often working with people in less than ideal health.

Guaranteed issue coverage from any life insurance company that offers it, will take high risk life insurance individuals.

Why?

Because the insurance company does not ask any health history questions. Health questions will eliminate a select number… say 10-15% of applicants who are in poor health for their age and can’t qualify for no exam, level benefit whole life insurance (full, immediate protection).

Sorry, the Alex Trebek life insurance plan is not demonstrating anything special. This whole life insurance policy is designed primarily for seniors who cannot qualify medically on a standard, no exam final expense insurance application.

Does Colonial Penn life insurance accept all seniors?

Yes, as long they apply and are approved between age 50-85. Power of attorney is acceptable in some cases.

Colonial Penn Insurance company is banking on you not knowing all your life insurance options though.

Make sure you speak with the right independent life insurance agent who works with people 50-85 daily. Don’t assume anything unless you have a terminal illness or late stage, internal cancer.

The Pro’s Of The “Guaranteed” Life Insurance Program

- This is permanent, whole life insurance that will never go up in cost nor down in death benefits. Lifetime coverage.

- Better than having no life insurance protection at all.

- First day coverage for accidental death…such as a car accident.

The Con’s Of Alex Trebek, Guaranteed Acceptance Whole Life Insurance

Guaranteed Acceptance coverage hands you a three fold penalty.

- Much higher premiums than the competition and commonly, lower value

- Limited benefits the first 2 years of ownership for natural death

- Limited maximum death benefit (face amounts). May not be adequate for many seniors final expense needs

Did you know these 3 key points prior to doing your research here?

With ANY guaranteed acceptance/issue life insurance, the first 2-3 years, the insured person is not covered with full benefits for natural death.

Many people miss that major detail. This is the highest risk the average elderly person faces.

No life insurance company offers individual life insurance without health questions and no medical exam without a mandatory waiting/limited benefit period. They must charge higher premiums and have a limited benefit period to offset their risk of loss.

Understanding The Fine Print Of Colonial Penn’s Guaranteed Acceptance Commercial Featuring Alex Trebek

So, insurance companies, including Colonial Penn, can’t approve applicants halfway in the casket with full life insurance benefits. They’d be unable to pay the claims. This is the reason why they insert a 2 year limited benefit period into the policy contract. This is also why the policy is has an elevated premium.

Life insurance is a giant money pool each policyholder pays into. Imagine several people paying one months premium for a $10,000 death benefit. Colonial Penn would be sunk real quick with a policy like that.

You see, life insurance is all about statistics. Colonial Penn knows by statistics what they must bill you for your policy when you buy. This allows them to make a profit with the risk profile they are willing to accept and pay out all claims.

If you have decent to excellent health as a senior, they really love you!! It helps them make a lot more money because you are lumped in with a large number of individuals who are very high risk because of their health.

Understand this…all limitations are applied to anyone who buys this type of policy. Not just the folks in very high risk health situations. It is automatic with a guaranteed issue whole life policy. Remember, there are no health questions. They “don’t know you from Adam.”

The Colonial Penn commercials have had a certain “magic” about them that washes away the reality of their “guaranteed acceptance” 995 life insurance plan.

The truth is, coverage is determined strictly by the terms written in the life insurance contract you purchase.

Alex Trebek insurance may feel like it is designed for all seniors as it accepts the healthy with the very unhealthy. That might be true but is it the best choice for you and your love ones?

I’d say no.

Now, I’ve covered one of the problems with the Colonial Penn, Alex Trebek life insurance commerical.

The next one really affects those seniors on a fixed income and/or are money conscious.

Have I got you curious?

Very Expensive Whole Life Insurance Alex Trebek Was Promoting

In the charts below, note that the pricing per month is displayed on top next to the appropriate number of units you would need to purchase. Once you have purchased a guaranteed acceptance whole life policy, the price will not go up and the benefits will not decrease. With Colonial Penn, you are limited by your age at application time on how much coverage you can buy.

Colonial Penn Life Insurance Rates By Age – Alex Trebek Insurance Advertisement

Female Maximum Benefits For The Colonial Penn $9.95 Per Month Plan

| AGE | 1 Unit/$9.95 | 2 Units/$19.90 | 4 Units/$39.80 | 6 Units/$59.70 | 8 Units/$79.60 | 15 Units/$149.25 |

|---|---|---|---|---|---|---|

| 50 | $2,000 | $4,000 | $8,000 | $12,000 | $16,000 | $30,000 |

| 51 | $1,942 | $3,884 | $7,768 | $11,652 | $15,536 | $29,130 |

| 52 | $1,890 | $3,780 | $7,560 | $11,340 | $15,120 | $28,350 |

| 53 | $1,845 | $3,690 | $7,380 | $11,070 | $14,760 | $27,675 |

| 54 | $1,802 | $3,604 | $7,208 | $10,812 | $14,416 | $27,030 |

| 55 | $1,761 | $3,522 | $7,044 | $10,566 | $14,088 | $26,415 |

| 56 | $1,719 | $3,438 | $6,876 | $10,314 | $13,752 | $25,785 |

| 57 | $1,669 | $3,338 | $6,676 | $10,014 | $13,352 | $25,035 |

| 58 | $1,620 | $3,240 | $6,480 | $9,720 | $12,960 | $24,300 |

| 59 | $1,565 | $3,130 | $6,260 | $9,390 | $12,520 | $23,475 |

| 60 | $1,515 | $3,030 | $6,060 | $9,090 | $12,120 | $22,725 |

| 61 | $1,460 | $2,920 | $5,840 | $8,760 | $11,680 | $21,900 |

| 62 | $1,420 | $2,840 | $5,680 | $8,520 | $11,360 | $21,300 |

| 63 | $1,370 | $2,740 | $5,480 | $8,220 | $10,960 | $20,550 |

| 64 | $1,313 | $2,626 | $5,252 | $7,878 | $10,504 | $19,695 |

| 65 | $1,258 | $2,516 | $5,032 | $7,548 | $10,064 | $18,870 |

| 66 | $1,200 | $2,400 | $4,800 | $7,200 | $9,600 | $18,000 |

| 67 | $1,167 | $2,334 | $4,668 | $7,002 | $9,336 | $17,505 |

| 68 | $1,112 | $2,224 | $4,448 | $6,672 | $8,896 | $16,680 |

| 69 | $1,057 | $2,114 | $4,228 | $6,342 | $8,456 | $15,855 |

| 70 | $1,000 | $2,000 | $4,000 | $6,000 | $8,000 | $15,000 |

| 71 | $949 | $1,898 | $3,796 | $5,694 | $7,592 | $14,235 |

| 72 | $896 | $1,792 | $3,584 | $5,376 | $7,168 | $13,440 |

| 73 | $846 | $1,692 | $3,384 | $5,076 | $6,768 | $12,690 |

| 74 | $802 | $1,604 | $3,208 | $4,812 | $6,416 | $12,030 |

| 75 | $762 | $1,524 | $3,048 | $4,572 | $6,096 | $11,430 |

| 76 | $724 | $1,448 | $2,896 | $4,344 | $5,792 | $10,860 |

| 77 | $689 | $1,378 | $2,756 | $4,134 | $5,512 | $10,335 |

| 78 | $657 | $1,314 | $2,628 | $3,942 | $5,256 | $9,855 |

| 79 | $627 | $1,254 | $2,508 | $3,762 | $5,016 | $9,405 |

| 80 | $608 | $1,216 | $2,432 | $3,648 | $4,864 | $9,120 |

| 81 | $578 | $1,156 | $2,312 | $3,468 | $4,624 | $8,670 |

| 82 | $549 | $1,098 | $2,196 | $3,294 | $4,392 | $8,235 |

| 83 | $521 | $1,042 | $2,084 | $3,126 | $4,168 | $7,815 |

| 84 | $493 | $986 | $1,972 | $2,958 | $3,944 | $7,395 |

| 85 | $468 | $936 | $1,872 | $2,808 | $3,744 | $7,020 |

Male Maximum Benefits For The Colonial Penn $9.95 Per Month Plan

| AGE | 1 unit/$9.95 | 2 Units/$19.90 | 4 Units/$39.80 | 6 Units/$59.70 | 8 Units/$79.60 | 15 Units/$149.25 |

|---|---|---|---|---|---|---|

| 50 | $1,699.00 | $3,398.00 | $6,796.00 | $10,194.00 | $13,592.00 | $25,485.00 |

| 51 | $1,620.00 | $3,240.00 | $6,480.00 | $9,720.00 | $12,960.00 | $24,300.00 |

| 52 | $1,565.00 | $3,130.00 | $6,260.00 | $9,390.00 | $12,520.00 | $23,475.00 |

| 53 | $1,515.00 | $3,030.00 | $6,060.00 | $9,090.00 | $12,120.00 | $22,725.00 |

| 54 | $1,460.00 | $2,920.00 | $5,840.00 | $8,760.00 | $11,680.00 | $21,900.00 |

| 55 | $1,420.00 | $2,840.00 | $5,680.00 | $8,520.00 | $11,360.00 | $21,300.00 |

| 56 | $1,370.00 | $2,740.00 | $5,480.00 | $8,220.00 | $10,960.00 | $20,550.00 |

| 57 | $1,313.00 | $2,626.00 | $5,252.00 | $7,878.00 | $10,504.00 | $19,695.00 |

| 58 | $1,258.00 | $2,516.00 | $5,032.00 | $7,548.00 | $10,064.00 | $18,870.00 |

| 59 | $1,200.00 | $2,400.00 | $4,800.00 | $7,200.00 | $9,600.00 | $18,000.00 |

| 60 | $1,167.00 | $2,334.00 | $4,668.00 | $7,002.00 | $9,336.00 | $17,505.00 |

| 61 | $1,112.00 | $2,224.00 | $4,448.00 | $6,672.00 | $8,896.00 | $16,680.00 |

| 62 | $1,057.00 | $2,114.00 | $4,228.00 | $6,342.00 | $8,456.00 | $15,855.00 |

| 63 | $1,000.00 | $2,000.00 | $4,000.00 | $6,000.00 | $8,000.00 | $15,000.00 |

| 64 | $949.00 | $1,898.00 | $3,796.00 | $5,694.00 | $7,592.00 | $14,235.00 |

| 65 | $896.00 | $1,792.00 | $3,584.00 | $5,376.00 | $7,168.00 | $13,440.00 |

| 66 | $846.00 | $1,692.00 | $3,384.00 | $5,076.00 | $6,768.00 | $12,690.00 |

| 67 | $802.00 | $1,604.00 | $3,208.00 | $4,812.00 | $6,416.00 | $12,030.00 |

| 68 | $762.00 | $1,524.00 | $3,048.00 | $4,572.00 | $6,096.00 | $11,430.00 |

| 69 | $724.00 | $1,448.00 | $2,896.00 | $4,344.00 | $5,792.00 | $10,860.00 |

| 70 | $686.00 | $1,372.00 | $2,744.00 | $4,116.00 | $5,488.00 | $10,290.00 |

| 71 | $657.00 | $1,314.00 | $2,628.00 | $3,942.00 | $5,256.00 | $9,855.00 |

| 72 | $627.00 | $1,254.00 | $2,508.00 | $3,762.00 | $5,016.00 | $9,405.00 |

| 73 | $608.00 | $1,216.00 | $2,432.00 | $3,648.00 | $4,864.00 | $9,120.00 |

| 74 | $578.00 | $1,156.00 | $2,312.00 | $3,468.00 | $4,624.00 | $8,670.00 |

| 75 | $549.00 | $1,098.00 | $2,196.00 | $3,294.00 | $4,392.00 | $8,235.00 |

| 76 | $521.00 | $1,042.00 | $2,084.00 | $3,126.00 | $4,168.00 | $7,815.00 |

| 77 | $493.00 | $986.00 | $1,972.00 | $2,958.00 | $3,944.00 | $7,395.00 |

| 78 | $468.00 | $936.00 | $1,872.00 | $2,808.00 | $3,744.00 | $7,020.00 |

| 79 | $441.00 | $882.00 | $1,764.00 | $2,646.00 | $3,528.00 | $6,615.00 |

| 80 | $426.00 | $852.00 | $1,704.00 | $2,556.00 | $3,408.00 | $6,390.00 |

| 81 | $424.00 | $848.00 | $1,696.00 | $2,544.00 | $3,392.00 | $6,360.00 |

| 82 | $423.00 | $846.00 | $1,692.00 | $2,538.00 | $3,384.00 | $6,345.00 |

| 83 | $421.00 | $842.00 | $1,684.00 | $2,526.00 | $3,368.00 | $6,315.00 |

| 84 | $420.00 | $840.00 | $1,680.00 | $2,520.00 | $3,360.00 | $6,300.00 |

| 85 | $418.00 | $836.00 | $1,672.00 | $2,508.00 | $3,344.00 | $6,270.00 |

We have updated these pricing tables for 2023. Colonial Penn has raised their rates effectively by lowering the value of a unit with their $9.95 per unit life insurance.

You may have noticed…

unless your quite close to age 50 particularly for men, the protection is not cheap and the amount of coverage you get for your monthly premium is low. In fact, if you are 70 + and buy this product, you may not have enough to simply cover the cost of a funeral and burial in 2023.

Now why is this?

Mentioned earlier but Colonial Penn uses a non standard way of calculating their premiums. I don’t care for it and I think it is meant to confuse or manipulate seniors into thinking this policy is very affordable regardless of your age at purchase. When I give you the competitors rate below for the exact same kind of guaranteed acceptance life insurance, you will see CP Guaranteed Acceptance is not so “affordable” at all.

Regardless of age, the maximum number or units you can buy is 15. For many folks, this is a real problem. Why? The older you are at the time of application with this Colonial Penn product, the lower the value of 1 unit is. That is why the rate charts above show lower amounts of available insurance the older you are at application. Once you purchase this policy, the value of the unit(s) will be locked and no longer decline. With whole life insurance, your policy death benefit can never go down in value nor will the price increase.

Now, for those people that may need this type of insurance, I ran a quick quote of the top guaranteed acceptance companies across the country. For reference, this quote is January 2023. Take a look at an apples to apples comparison in the appropriate chart.

The first quote below is a fictitious, 75 year old female. The second chart is a fictitious 75 year old male applicant. Both are for $10,000 of no medical question, guaranteed issue whole life insurance with a 2 year waiting period for full benefits. Same ease of application and whole life protection as the $9.95, Alex Trebek life insurance w/Colonial Penn.

About 85% or more of you reading this article would more than likely be able to qualify for the full, level benefit life insurance with the right insurance company. We can help you determine the best carrier and policy is for you. This will also save you an enormous amount of time and a lot of money. All by answering a few health questions. No doctors, nurses or needles in your arm. Just a few health history questions will also offer better benefits from day 1 of the coverage.

You may choose to use the instant Final Expense Insurance quoting tool on this page. Be sure to select “Excellent Health” if you believe your health is pretty average or better for someone your age.

Yes, all the plans quoted here are designed for those in less than perfect health and have no medical exam.

People age 50-85 are the typical buyers of no exam burial insurance. Most folks are able to obtain much, much lower rates for whole life insurance with full protection from day 1. The 10-15% remaining still have more affordable options than Colonial Penn guaranteed acceptance insurance.

Do you have any objection to saving a lot of money and being able to obtain the best policy you qualify for?

Remember, this is better not only for you but your family who will be getting the full death benefit if you pass away in the next 2 years.

Tips On Life Insurance Alex Trebek Never Gave You

Here is our first tip. Don’t spend your time calling insurance companies like Colonial Penn. You don’t have many options. They are not going to help you get the best insurance policy you can qualify for. They sell you what they are marketing. Currently, for people 50-75 that amounts to 2 Colonial Penn life insurance policies and just 1 if you are 76-85. You will not be told that you can get a better policy, price or value elsewhere.

Be sure to have the help of an independent life insurance professional who can sort out the good plans from the questionable ones. It does not cost you a nickel for a professional to help you find the best policy. Start by having them evaluate what you can qualify for healthwise. They will shop the life insurance market for the right, no exam policy offering the best benefits and lowest price.

Misunderstanding life insurance policy limitations and features combined with the overall costs of ownership are the common mistakes of consumers. There is no reason not to utilize a professional independent agent. You don’t pay anything for their services, the insurance companies do that part.

“Life insurance” is not created equal. Having a real professional advisor protects not only your interests but that of your family. They put you in front of the most benefit rich and affordable final expense plans you can buy. Make sure you have the right product ladies and gentleman.

You can spend weeks calling around different insurance companies and never find the best rates let alone one that you qualify for healthwise if you have a tough medical condition or two. With that said, a good independent agent can quickly give you all the information and pricing you spent weeks or months on and identify which company and product would be best for your needs and health scenario.

Here are some typical health questions on a no exam application. This policy full, first day whole life insurance. Either “yes” or “no.” Optionally, you can see what company and plan you qualify for by using the instant quoting tool on this page. Enter your details and request an application for the company and plan you are interested in. From there, you will be automatically emailed a health questionaire asking you to answer some basic health history questions. We will assess what company and plan would likely be best for you and your family.

Problems With The Alex Trebek Insurance Offer

Something to be aware of…

While all insurance companies have a certain amount of complaints against them, Colonial Penn has a much higher than average number complaints against it.

Lots of upset families that did not know or understand that the Alex Trebek $9.95 life insurance offering has significant limitations built in. We’ve discussed those previously.

The limitations are disclosed if you take a close look at the commerical and website, but carefully placed to be casually overlooked by those who are focused on the celebrity endorser who’s selling you on the coverage.

I see no blatant dishonesty, but the responsibility is completely shifted onto a trusting senior who just wants affordable peace of mind for their family. It seems “slippery” from my perspective.

No Health Question $9.95 Life Insurance And The Alex Trebek Insurance Ad

Since the Alex Trebek advertisement focuses on the $9.95 “guaranteed acceptance” product with no health questions, we are presenting all the facts here so you understand the limitations of this product.

Something I didn’t address thoroughly was the use of the term “rate lock” promoted in all the commercials.

With all whole life insurance, rate locks for your lifetime are a standard feature. It is built into the policy. Ultimately, the rate lock Mr. Trebek mentions is a marketing term that is always a feature in any whole life insurance product.

The 30 day money back guarantee, well that comes from the department of insurance in each state. States require life insurance companies to include a free look, 20-30 day period so you can evaluate the policy to decide if they want a refund or not. All insurance companies must follow the free look provision laws.

Again, watch the marketing glitz. The Alex Trebek life insurance ad has lots of gimmicks that are easy to fall for. Weed it out.

With all that said…

Maple Valley Insurance Group Rating of the Guaranteed Acceptance Whole Life Insurance from Colonial Penn = “D”

It is not responsible of a life insurance company to recommend a product built for very poor health applicants and market as a very affordable final expense solution for seniors. We believe it is misleading. There simply are a lot of better options out there. Most burial insurance companies have far superior offers than Colonial Penn and at a much better price.

The fact is, any kind of guaranteed issue life insurance, regardless of the insurance carrier simply cannot claim this. It cannot compete in coverage and affordability with the best whole life insurance products on the market.

Guaranteed acceptance/guaranteed issue whole life is the life insurance product to select after all other no exam, simplified issue whole products have been ruled out by working with a experienced professional. It should not be “plan A” or even “plan B” for that matter.

Every week I take phone calls from people calling to price out final expense life insurance. We frequently replace guaranteed acceptance policies with better benefits and lower cost policies. These clients were shocked at how much they were losing by buying whole life insurance Alex Trebek endorsed. Many did not realize that they had a 2 year limited benefit at all!

Buying life insurance in units?

This is not a good way to be transparent about the cost of buying a policy either. Only a very, very small amount of burial insurance consumers pay $9.95 a month to protect their family with Colonial Penn Guaranteed Acceptance protection.

Why?

Because it simply does not buy enough burial insurance to cover the costs of death.

This is not how life insurance is typically “priced.” Again, it appears to be a marketing tactic to distract you into thinking it is very affordable life insurance. Life insurance is priced based on your age of your first payment and how much financial protection your family needs.

The younger you are at purchase, the lower your lifetime price on whole life insurance with that company. Remember their is a “rate lock” on ALL whole life insurance, not just Colonial Penn.

We always recommend working with a independent professional to see if you qualify for better benefits and lower premiums.

Alex Trebek Insurance Commerical For Seniors

By now you probably realize I’m not impressed with the ad nor the product itself. Coverage is marketed towards trusting seniors that are looking for dependable life insurance to meets the needs of their family. Most people just want the straight scoop without all the games and limitations.

Most people we work with desire the most benefits they can get for the dollar spent. In other words, value. This is what protects their family. This Colonial Penn product is not benefit rich nor priced well. Where’s the value in that?

While some people will only qualify for guaranteed acceptance life insurance, you need consult with a experienced independent agent or brokers before assuming you need it.

Why?

Your loved ones could end up in a financial mess because of the 2 year limitation on coverage for natural death. I’m sure you don’t want your loved ones in a mountain of debt by getting caught in limitations of coverage.

The unit system used in this Colonial Penn 995 plan penalizes seniors particularly in their 70’s and 80’s. This means that they may not be able to purchase a enough financial protection (death benefits) to ensure their goals are met.

Remember, the average cost of a full funeral is around $10,000 nationally. This does not even count the actual burial costs at the cemetery. Plenty of people have told me they just paid over 10k in funeral costs alone in this past year (2024). We recommend a goal of at least $15,000 to cover full funeral and burial costs for 2024. Inflation over time and if your budget allows, 20-25K would be better. If you in your early 50’s, you should be considering if you have a budget for a $30,000 policy.

Yes inflation.

As of 2021 we have seen a crazy spike in prices haven’t we? Funeral and burial costs have been rising steadily for years but 2021 is a reminder that managing raging inflation should be part of the financial planning for our family. Could funeral and burial expenses double in the next 10-20 yrs…a distinct possibility! Be sure to review the rate chart above and see the maximum amount of financial protection that can be bought at your current age with CP.

Do you want to assume and pay more money for coverage because Alex Trebek was paid to endorse it?

Regardless of what the Alex Trebek insurance commerical said, Colonial Penn guaranteed acceptance is not particularly affordable when doing an apples to apples comparison with their competitors. Certainly not when it is compared to the best final expense, no exam whole life insurance we offer here.

What is the value of overpaying for less benefits?

Weekly I find myself talking to new seniors who were duped into the wrong life insurance product. They bought a term policy that is/was about to expire or bought a “guaranteed acceptance” policy from one of the few life insurance companies that offer them.

Folks, take the time and call a professional. Find out what is really available to you. See if you can qualify based on your overall health for a simplified issue, no exam, medically underwritten plan first. Simplified issue, no exam life insurance is actually designed for people age 50-85 and may not been in “excellent health.”

Watch out for other high priced guaranteed issue whole life plans.

Is Alex Trebek insurance a scam? Absolutely not. For a person who is in a high risk situation, the life insurance he promoted could be one of a handful who insure someone who is a high risk individual. While quite expensive compared to the more competitive companies, it is not a scam. Colonial Penn has been allowed to sell their life insurance by the each department of insurance in most states in the country. No insurance company may sell a product in your state without approval from that state government.

While the ad seems deceptive, you just have to realize $9.95 is a teaser rate to capture your interest in the product. It buys you 1 “unit” of their life insurance. Their intention is to get you to call Colonial Penn and just buy the policy. In fairness, they do not know your age nor gender. The life insurance Alex Trebek endorsed @ $9.95 per month does not buy very much peace of mind for the vast majority of consumers.

The older you are on the date of purchase, the less that $9.95 per month will buy in real financial protection for your loved ones. Truth is… a great majority seniors we work with purchase much more protection than this plan can offer.

For those who purchase the coverage…Colonial Penn will pay the claims according to the terms of the policy. Yes, Colonial Penn is a very legitimate life insurance company. That is all. If you misunderstood the written policy sent to you, they are not liable. Your loved ones will receive what is written in the policy provided you keep up with your payments. Always read your policy when you get it. It is worth a few minutes of your time. Make sure there are no surprises. If you are not satisfied, use the free look period and cancel the policy promptly. By law, the insurer must return your initial premium if you are not satisfied…no questions asked.

Should I Buy The Whole Life Insurance Alex Trebek Promoted?

The Colonial Penn commercial just puts a bow on a policy that has a lot of risk for your family during the first two years of ownership. This policy also comes with a very high lifetime price tag. Determining the need for high risk life insurance should be done only with the counsel of an independent life insurance specialist. Never try to sort this out on your own or call an insurance company home office expecting to get the best advice. You could end up ripped off and/or underinsured. This could be devastating for your family if you buy the wrong policy.

Most people 50-85 can qualify for much better coverage than they believe. Final expense life insurance marketed by Colonial Penn is typically sold to people on a fixed and/or limited income rather than a wealthy person who has a lot of financial assets. This product is not for afluent individuals who need large policies to cover hefty estate taxes or for pension maximization. This product is also for those people who need a smaller burial insurance policy and who may not be able to qualify otherwise based on their overall health for a better policy elsewhere.

The ads you see to buy Colonial Penn, Globe Life or AARP/New York Life etc, are rarely in your best interest. These carriers engage in a numbers game of mass marketing and/or gimmicks. Those companies would rather you did not do your due diligence.

Folks, the easier life insurance is to qualify for, the higher the cost of purchasing it. Colonial Penn guaranteed acceptance is as “easy” as they come. It is important to remember the wrong type of whole life insurance may increase the risk to your family of not receiving the monies you intend just because the wrong policy was purchased.

Do you want to save money and obtain the best benefits available or…

would you prefer to worry for 2 years just so you don’t have to answer a few health questions?

Which one would truly give you and your family real peace of mind and security?

We recommend going the Plan A route first.

Sure, I’m bit biased myself because I have access to all the top burial insurance companies and plans out there. As a life insurance field underwriter and independent agent/broker I don’t have to rely on Alex Trebek insurance to meet the needs of my clientele either.

Alex Trebek Colonial Penn Life Insurance Rating and Conclusion

At Maple Valley Insurance Group, we don’t put “square pegs in round holes” regardless of the celebrity marketing, nor should you. Now that you know the real cost of $9.95 life insurance, put away your thoughts of Alex Trebek insurance. There are much better whole life policies available which also include much lower pricing then the Colonial Penn 995 insurance plan.

Maple Valley Insurance Group rating of this policy from Colonial Penn = “C-“

Good life insurance policies for people 50-85 are offered by several different life insurance companies. They just don’t mass market them because the essentially “sell themselves.”

How do they do this?

Simple. They offer you benefits not found in Colonial Penn’s insurance at a much more affordable price.

Always have an independent, seasoned professional verify your need for any guaranteed issue life insurance before buying.

Why?

Because all life insurance companies have different health questions. There may be several companies unable to insure you for immediate, full benefits while another can give you that same coverage very affordably without needing to resort to high risk life insurance.

Almost daily we have people who think they can’t qualify for the best benefits and lower premiums. After a few minutes on the phone, they find out they can easily qualify for a premium policy for a much lower premium than Colonial Penn.

Even if you have been declined elsewhere, don’t lose heart.

About 5-10% of our cases where guaranteed acceptance whole life insurance is truly necessary, we generally recommend the likes of AIG or Gerber Life not only for pricing but the amount of available protection over the whole life insurance Alex Trebek pushed for Colonial Penn. They also both offer additional benefits during the first 2 years for natural death causes and allow seniors in their later years to obtain $20-25,000 policies that are popular in 2024 for final expense planning.

If you want to learn more about which life insurance might be best for you and your goals, check out our article on no exam whole life insurance which will talk about the different types of whole life insurance with no medical examinations for people 50-90.

You’re certainly welcome to experiment with the instant quote tool on this page as well. Compare Alex Trebek life insurance rates by selecting “Poor” under the health classification menu. Better yet, give us a call and let’s talk about your needs and find the right plan to protect your family.

If you’ve found this article helpful, let us know. We welcome comments below.

We’re always here to help. Phone: 269-244-3420