A master marketer, AARP has grown to over 37 million subscribers. The not for profit organization has amassed a very large group of people to be marketed to. I have been on their mailing list myself since I turned 50!! In this post, you will get an AARP life insurance review from a professional agents point of view.

Now, you should know that AARP is not an insurance company. They don’t pay claims. They do not underwrite insurance policies. However, they do license the use of the AARP name to bidding insurance companies who wish to offer an insurance product to the members. Paying to use the AARP name allows a insurance company to brand their insurance policy with the actual AARP logo on it. AARP may or may not endorse the specific product but it does allow life, health and even auto insurance products to be marketed to its members. Those people who purchase the AARP branded products will be required to pay $16 a year to maintain a membership status with the organization to purchase this life insurance.

Insurance companies pay heavily for permission to use the AARP brand name on their products. One company is awarded the use of the logo for life, health and auto insurance. AARP life insurance for seniors is underwritten and offered by New York Life. Health (Medicare related) insurance is underwritten and offered by United Healthcare. For your car… automobile coverage is provided by The Hartford.

Each of these insurance companies have their own licensed agents that sell these insurance products to members of the association.

In this article, I will be putting the 3 AARP labeled life insurance offerings from New York Life under the microscope.

We are evaluating life insurance for people 50-90 here, giving both facts and our opinion on these 3 products. We are a licensed, independent life insurance agency with the experience, training and education in the industry.

Just a heads up to any AARP members…you are going to get the truth in this review. I receive the same membership paperwork you’ve received. Don’t take anything personally but don’t assume that these policies are anything special either.

If a product is low quality and/or overpriced, we will highlight it. I’m not here to be a nice guy, just call as I see it as a very qualified, seasoned professional actively working in the life insurance business 6 days a week.

The following questions will be answered:

- Is AARP life insurance worth it’s salt?

- Do the products provide good value for the typical retiree on a fixed income?

- Are these among the best offerings on the market for your dollar?

- What are the AARP life prices like? Is it really affordable?

- Do the AARP life insurance plans really have seniors best interest in mind or is it just fluff to make a buck?

- Are there better options for you?

Here we go.

AARP Life Insurance For Seniors

There are a total of 3 policy offerings available with the AARP New York Life Insurance program. 2 of them are designed for senior end of life expenditures. These policies are based on whole life insurance. Be aware, the 3rd product is NOT designed for final expense, end of life needs. This particular policy expires at the 80th birthday of the insured individual.

The 3rd product is really an outlier product for seniors. It is is a term life insurance policy that includes increasing premiums in 5 year rate bands. The policy premiums will increase until expiration is reached.

Yes, AARP is paid handsomely for licensing its brand name to New York Life.

Should you assume that these offerings are top notch?

I don’t think so. Reading most reviews about AARP life insurance is going to make this clear. I think the tendency is to assume the association is “looking out for seniors.” This is where life insurance consumers get blindsided. It is a insurance product of New York Life, not the associations creation.

Ultimately the business relationship with AARP raises the price of the New York Life products offered. This makes it hard for them to compete against other insurers who offer premium life insurance products without added marketing and licensing expense for the “AARP” logo stamped on it.

No Medical Exam Life Insurance

Easy issue, no exam life insurance is quite common. Often it is a good option for people in less than excellent health or those consumers who need a smaller policy amount. All 3 AARP life insurance policies are no medical exam products. This makes acquiring life insurance for someone age 50-80 significantly easier to obtain. No needles and no one visiting you at your home putting you on a scale or sending you into the bathroom with a cup. No medical exam life insurance is very popular with consumers 50-89 for final expense planning.

The only downside is that coverage will cost more without a paramedical exam requirement.

Why you may ask?

The insurance company cannot verify your current state of health without a paramedical exam. In other words, they don’t get to know you as well to better assess you as an overall risk. As such, they raise premiums somewhat to offset the uncertainty.

No Exam life insurance is easy enough to find and quite common in the industry. Applcation and approvals can come very quick. Depending upon the insurance companies applications process, minutes to a couple of days.

The AARP Term Life Insurance Policy

AARP Level Benefit Term Life is the only term life insurance option for association members.

If you were not aware, term life insurance is temporary coverage. You are “renting” life insurance protection for a certain time period, after which the coverage and/or the pricing “terminates.”

The AARP, NYL term insurance plan from New York Life expires promptly on your 80th birthday.

If the policy expires prior to the insureds death, the beneficiary(s) receive nothing.

The owner of a term policy is paying for pure life insurance protection only. There is no cash value or return of premiums in this policy.

AARP level benefit term life insurance is available with death benefit amounts ranging from $10,000 to $150,000. Higher amounts are available but special approval is required.

As a simplified issue policy with limited health questions, the term life policy is designed to accommodate less than ideal health which can help with ease of qualification. Your answers to some basic health questions will determine general eligibility for coverage.

Most people who apply are accepted.

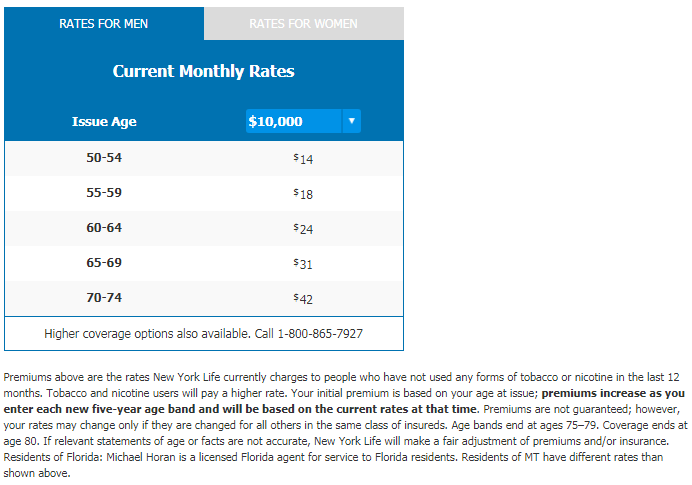

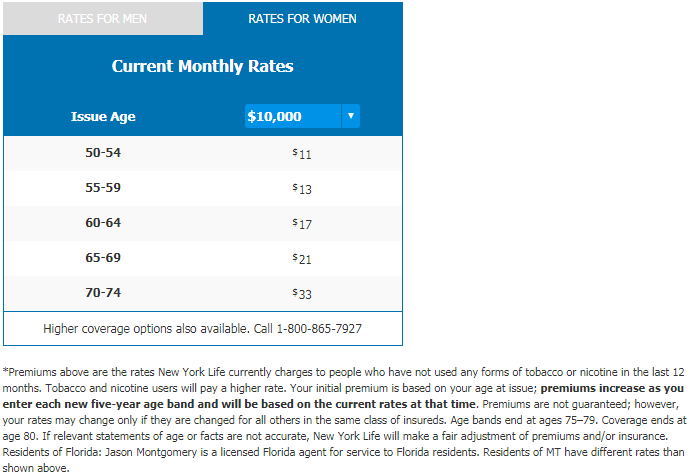

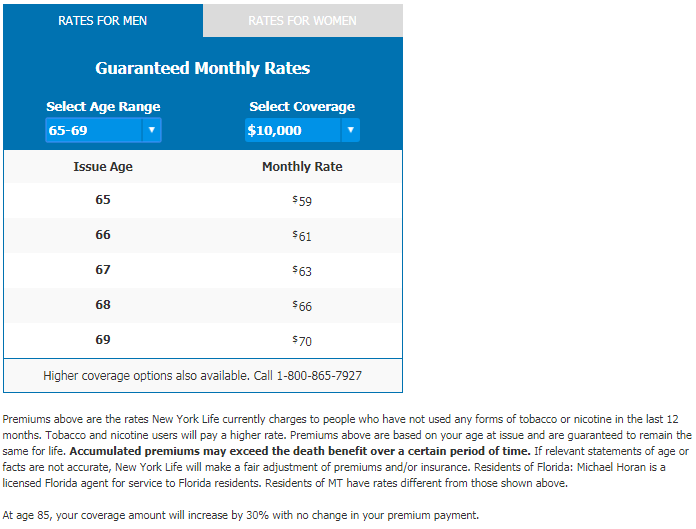

Now, go down below and take look at the AARP term life quotes from their website from 2020.

Looks pretty great right? Well, until the shocking facts come out. Notice: It is advertised with the terminology “affordable rate that increases over time.”

Your rates are not guaranteed here folks!! Those rates will also go up on you in 5 year age bands. Yes, unlike guaranteed level term life insurance, the rates do not stay fixed. So yes, you will have rate increases on this policy.

Examine the fine print in the snapshot we included below.

If you know your needs only require term life insurance, we advise you to get an instant comparison quote of the top term life insurance companies and rates for seniors.

Here’s the reality of AARP Level Benefit Term life insurance. It starts off at age 50 being affordable only to go sky high at age 75. Not good timing. The New York life policy increases in cost every 5 years regardless of your health until it expires. You really don’t know what you might be paying, just an estimate. Nothing has a written guarantee except the face amount (death benefit).

This policy is a bit deceptive in my opinion. When the insured turns 75, the policy gets expensive. AARP New York Life term life insurance policy owners tend to drop the policy at this point. Now, whole life is their only solid choice due to advanced age. Whole life is now more expensive than it would have had it been purchased day 1. Money is not saved on this term life policy unless you have a crystal ball or know how long you need protection for.

When the AARP branded policy expires on your 80th birthday, often it becomes very difficult to qualify for other whole life insurance.

Like the majority of term policies on the market you are guaranteed the right to convert your policy to a permanent, NYL whole life insurance policy. This however must be done before expiration. The pricing at that time will be based on your advanced age. This will lock your premium for life.

Important note: Having experience helping a few unhealthy people convert their NY Life AARP life insurance policy to whole life insurance, I’ve found the rates to be very high. The are not competitive with the best. Be warned!

Whole life insurance with New York Life gets very, very expensive at age 75 particularly for men. Do you expect your health to be the same at 75 or 80 compared to age 60 or 65?

If you fail to act before the conversion expiration date, you would be required to qualify again based on your health in which case, you may be declined for coverage with the AARP life insurance plans.

You will have some hard decisions to make at that point. It is going to be a lot more costly!!

Ladies and Gentleman, at Maple Valley Insurance Group, we have worked with plenty of very frustrated people over their AARP life insurance policy. We know the complaints all to well.

Final Expense life insurance should be whole life insurance from the very beginning. Lock the rate and your best health in for your lifetime to protect your loved ones.

Any term other than level premium term life insurance is a low policy to start with and should be avoided regardless of the initial teaser rates.

The world hasn’t become less expensive to live in. Plan for the future. Is it worth saving a few bucks each month only to pay thru the nose at age 75 and beyond?

Do you want a policy that goes up in price as the cost of living increases? Most seniors we work with are on a fixed income.

That is a double whammy!!

Where do consumers go wrong with this policy?

Typically, they are attracted by the initial low price but don’t understand the inevitable expiration or the rate increases built into the policy. Some folks thought they could by whole life insurance later, if they needed it. Problem is, now their health declined and it is considerably more expensive due to advanced age.

Folks, regardless of the company, life insurance gets more expensive to apply for as you age. It is not like automobile or homeowners insurance. There are consequences for choosing the wrong type of life insurance the first time around. Work with a independent agent or broker who can get you the right protection your family needs.

Continuing on…

The value of the premiums paid on this AARP term policy over time needs to be considered. While the death benefit stays level, the policy premium is not level and can really bleed your wallet over time.

How many people do you know that are age 80 or more? Personally, I know a lot! Average life expectancy in 2020 for women was a notch off 80.

My own Mom is still cooking along in her 80’s.

This is a ticking time bomb policy often expiring worthless. How does that secure your loved ones financial needs?

Trying to buy permanent life insurance at age 80 can be expensive even if your health is still pretty good. Most elderly people must face the odds that multiple health issues will reduce your options with insurance companies.

In the opinion of the author it is nothing short of irresponsible to market term life insurance as final expense or burial insurance. Term insurance is NOT for final expenses. Term life insurance is designed for the “what-ifs” in a defined period of time. A mortgage is a defined period of time and good example.

Isn’t lifetime dependability for your loved ones most important?

Ask yourself before purchasing any life insurance. Why am I doing this?

To be fair we have provided an example AARP term life insurance quote in a chart below. Rates are little outdated for 2024 but you will get the point.

Let’s start looking at the different NYL AARP life insurance plans below.

AARP Whole Life Insurance Policy

Now, this is a product designed to get the job done for seniors. This whole life based product is the best burial insurance product NYL offers to AARP members.

People are just simply living longer aren’t they?

Modern medicine certainly has a lot to do with it.

AARP Whole Life Insurance offers a lifetime of protection and a guaranteed level premium for life.

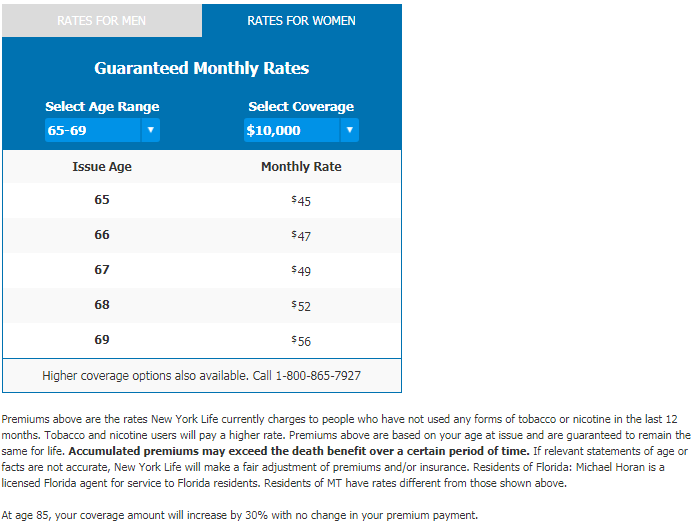

Take a look at the 2020 rates on the AARP Whole Life Insurance sample below.

While it may not be the 2024 rates it gives you a basis of comparison. Yes, rates have gone up a bit in the last 4 years.

Important points about this specific policy: You can obtain coverage all the way up to $50,000 and still have no medical exam. This policy will not expire since it is whole life insurance. Regardless of when you pass, the policy will pay the full death benefit amount to your loved ones.

Full benefits are available upon acceptance and the required premium. In other words, there is no waiting period for full coverage. You can apply thru age 80. Health history questions are part of the application process.

This is a quality policy designed for the lifetime of a senior planning their final expenses. Your premium cost will never change and your benefits never decrease regardless of age or your health.

This type of whole life policy is known as “simplified issue.” Most seniors 50-80 who apply will be approved.

Higher coverage amounts may be requested, but requires additional approval before official application can be made.

This AARP, New York Life policy will accrue some cash value, after a couple of years.

We do not recommend the use of the cash value inside these policies for loans unless you will definitely be able to repay the loan. Why? Because it will decrease the payout to the beneficiary upon your passing if it is not reimbursed to the policy prior to death.

My evaluation…this is the best of the 3 products New York Life offers AARP members for end of life plannning.

With that said, you should know…

The Con’s: AARP Whole Life Insurance is quite expensive compared to the top life insurance carriers on the market. This policy is a standard, simplified issue whole life policy. There are a lot of life insurance carriers out there that will offer you the same policy or even better with much better pricing.

So with that said…

There are much better “values” out there for your money.

Want to see, fill out the instant final expense quote tool on this page. Select “Excellent Health” under the “Health Class” and you will see why the AARP whole life insurance rates are not competitive very quickly!!

The AARP Guaranteed Acceptance Life Insurance Policy

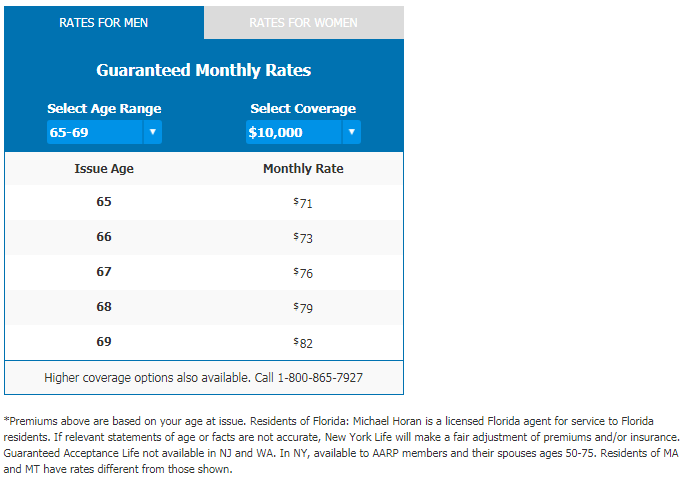

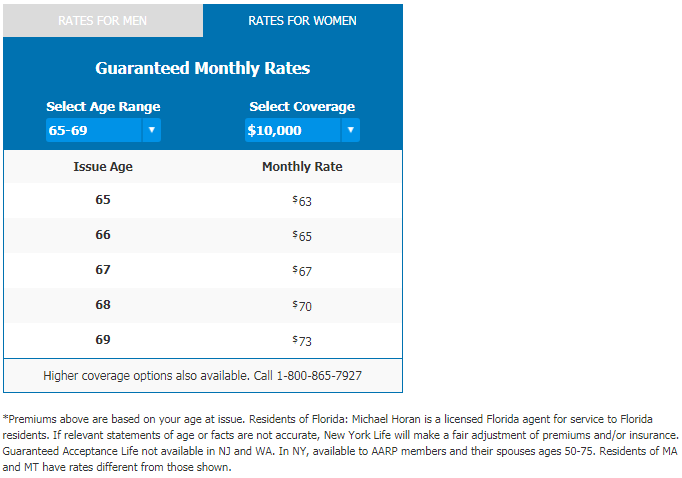

Ok, sometimes called AARP guaranteed life insurance, here is where their policies get real pricey… AARP Easy Acceptance Life Insurance.

The AARP guaranteed acceptance life insurance capped at a maximum death benefit of $25,000. Applicants thru age 80 can get a lifetime policy.

This is also the most expensive product of the 3.

Why?

For starters, this is pure, high risk life insurance.

This product is a permanent, whole life insurance policy that does not ask any health history questions. Most of the time, this does not work in the policy owners favor nor that of the beneficiary.

As a result, it has some very significant limitations you should be absolutely clear on before purchase. It effects not only you but your beneficiary’s future.

With “AARP guaranteed life insurance”, all qualified individuals regardless of health that can legally consent to the coverage on their own, can be insured. Again, there are no health questions asked. The insured applicant’s age cannot exceed 80.

Not exclusive to AARP, New York Life, all guaranteed acceptance policies on the market have a limited benefit period during the first 2 years.

Why?

The insurer in this case, New York Life has very little information about the insured person. As a result, are taking a very significant gamble. Not knowing anything about the insureds health removes the best tool they have for evaluating their applicant in terms of risk assessment.

Look below for the rates on the AARP Easy Acceptance Life Insurance product.

Now, if you have a terminal condition, taking medication for memory issues, have late stage cancer, need an organ transplant, this is all you probably qualify for. There are just a few reputable carriers that offer this type of life insurance. If you’d like to see who would offer the best rates for guaranteed issue life insurance, use the free tool on this page for an instant quote. Under the “Health Class” select “Poor.” This will compare the rates of the top guaranteed issue life insurance companies for you.

AARP Easy Acceptance Life Insurance is also a whole life insurance policy which means you cannot outlive the benefits. Your premiums will never go up nor will the death benefit go down regardless of age or declining health. The one exception to this… any cash value that the policy owner borrows from the policy and not repaid.

Beyond the higher premiums…

The key point to remember… This policy will not cover the insured in full for natural death causes during the first 2 years.

Any guaranteed acceptance whole life policy has what is called a limited benefit clause in it for the first 2 years.

During this “limited” waiting period, if natural death occurs to the insured, the beneficiary would receive a refund of all paid premiums plus compounded interest. Many carriers will pay 10% interest. If you paid $100/month for 12 months and died due to a natural cause, your family would receive $1200 + the interest as the death benefit. After 2 years, the policy will be paying the full benefit for both accidental and natural death.

AARP guaranteed life insurance will cover you 1st day in full for accidental death for life.

I have a question for you.

Would you have peace of mind buying this particular AARP life insurance plan just because there are no health questions? Why not try to get a more affordable whole life insurance policy with 1st day full benefits and a few health history questions on the application? Are you assuming your health not being A1 means you won’t be approved?

Talk to an independent life insurance agent or broker. Let them determine what you prequalify for and what is the best insurance company to apply to.

Our recommendation is to leave this type of “guaranteed” whole life insurance as “Plan B” if you cannot get covered medically.

For those who have checked with an independent agency like Maple Valley Insurance Group and could not medically qualify, this type of coverage can be a saving grace. However, you would be better off with another carrier with better pricing.

NYL AARP Life Insurance Quotes (2020)

NYL has raised AARP life prices since 2020, but not that much. The point of these charts is just to do a simple comparison between the 3 products they offer members of AARP. You should have gotten your free quote from our instant quoting tool right here. See for yourself how overpriced these policies can still be in an apples to apples basis now that it is 2024.

Level Benefit Term Life Insurance Rates

AARP Term Life Insurance Quotes For Men

AARP Term Life Insurance Quotes For Women

Permanent Whole Life Insurance Rates

AARP Whole Life Insurance Quotes For Men

AARP Whole Life Insurance Quotes For Women

Guaranteed Acceptance Whole Life Insurance Rates

AARP Guaranteed Acceptance Life Insurance Quotes For Men

AARP Guaranteed Acceptance Quotes For Women

Life Insurance For AARP Members Only

NYL only offers these 3 specific life insurance plans to members of AARP. If you are not already a member, you will have pay membership dues to apply for any of the life insurance policies.

Best AARP Life Insurance For Seniors Over 70?

Unless you only need life insurance from NYL until your 80th birthday, you should only consider their whole life insurance options. AARP term life insurance expires promptly on your 80th birthday. If your health is decent, the simplified issue whole life policy is going to be the best choice. While the guaranteed issue policy sounds easy because there are no health questions, it should be used only if you cannot qualify for a first day, full benefit policy.

Are these the best policies for seniors over 70 and members?

No. There are many insurance companies with superior policies and rates. They just do not market to consumers thru AARP.

Any Life Insurance For AARP Seniors Over 80?

No. Not with the associations logo on it.

If you did not purchase a permanent, whole life insurance policy from AARP/NYL prior to turning age 81, you are ineligible to apply for any of the policies.

No worries, we’ve got you covered at Maple Valley Insurance Group. Working with seniors over 80 regularly, we help our clients secure affordable, whole life insurance (lifetime coverage) from a number of the top rated insurance companies. We recommend giving us a call at 269-244-3420 or alternatively using our final expense quoting tool on this page to see the best rates and policies. If you are in decent health for your age, use “Excellent Health” to bring up the best plans and rates you may qualify for even if you are over age 80!

Is AARP Life Insurance Worth It?

AARP life prices are very high. You can definitely do much better elsewhere.

You’ve probably sensed my bias against the AARP Guaranteed Acceptance Life Insurance offering.

Honestly, it’s not that I don’t like it, it is simply an “over prescribed” product in the vast majority of health cases we come across. In other words, unnecessary for the 85-90% of applicants.

At Maple Valley Insurance Group, we are in the life insurance market daily working with people 50-85 who rarely need this limited, expensive policy. For those who ultimately do, there are carriers such as Gerber Life and AIG with the same no exam, no question, guaranteed acceptance policy at a much lower price.

Many of our callers don’t understand the limitations of “guaranteed acceptance” nor how much extra they are paying for this policy. The vast majority of our clients qualify for lower rates with a standard, simplified issue whole life policy with full, immediate benefits. A superior type of whole life insurance.

There are situations where Guaranteed Acceptance life insurance is absolutely needed. Do yourself and your family a favor, don’t buy it unless there is no better solution. I suspect you will hear this in other AARP life insurance reviews as well. The higher pricing and 2 year limited benefit period remove a lot of the value of the insurance. Incidentally, do not try to self assess yourself and what you would qualify for… unless you have been diagnosed with a terminal illness, Alzheimer’s, Dementia or have late stage, internal cancer. (Prostate cancer and early stage breast cancer is an exception in some cases with a couple insurers)

Having no medical questions on a life insurance application raises the rates up and lowers the policy benefits!!

Why?

Simple answer: Insurance companies cannot evaluate the risk profile of the insured individual. Since they have no clear picture on whom they are insuring they must assume the risk is very high to them.

The policy sounds great when you don’t know the reality of the policy.

If you have a serious condition as I mentioned previously and thinking you need AARP Guaranteed Acceptance life insurance, take a pause. Gerber Life or AIG usually have the best rates. Use the Final Expense Quoting Tool on this page. In the “Health Class” drop down menu, select “Poor Health.”

Thumbs down on the AARP term life insurance policy.

Obtaining an AARP term life insurance quote is easy enough when you look at the chart above. Just remember, those rates are going to rise until the policy expires on you. The age brackets are in 5 year increments. Rates are not locked. There are no guarantees on the cost. Review the fine print again as needed for clarity.

People are being teased with low, initial teaser rates to hook them. By the time you hit 75 the price is ridiculous and you may have been paying for the last 20+ years.

And…

It simply is not good for final expense protection. Not only does the price go up on you in 5 year age bands, but it EXPIRES on your 80th birthday, automatically!

As a company, we regularly hear from disappointed or very upset people who dropped the coverage after they have had it a few years. Most often, these are consumers on a fixed income.

How does that help our loves ones in our absence?

Avoid this product unless you know exactly how long you need protection. Can you afford the rates at at 70 and 75 as you age?

You were warned here. Too much negative feedback from former AARP customers regarding their experience.

Clearly, AARP’s best offering is their permanent, whole life product which is just a simplified issue life insurance policy with some health history questions. It is still a no exam, simplified medical underwriting policy that the average senior can qualify for.

While still very overpriced, it is first day whole life coverage, the meat and potatoes of senior burial insurance policies. This policy will offer the best benefits of the 3 for you and your family.

A good majority of applicants will qualify…regardless of being in their “golden years.” Keep in mind, this product is senior oriented and forgiving of common health issues.

If there is a downside to the AARP/NYL branded whole life policies…they are not very competitive.

You can get the same or even a better policy elsewhere and save a lot of money in the process.

And…

Yes, these alternative products are from top life insurance carriers.

Is there any reason you would want to pay the AARP life insurance cost?

Is AARP NYL Life Insurance Legit?

Yes.

New York Life has been in business since 1845. They are the insurance company offering the AARP branded policies to members. If you are asking this question, I would suggest you give us a call. Don’t put try to put a square peg in a round hole. All life insurance companies are legit but some of the policies they offer may NOT be the right policy at a fair price. Apples are not apples with life insurance policies.

I have no reservations about writing business with New York Life on their better products. These 3 we reviewed today are average to poor.

In our AARP life insurance review for seniors, we hope you have learned how to select the right policy and save money on no exam, senior life insurance thereby avoiding policies that are not in your best interest. It starts with working with the right people.

Am I saying you should go cancel your life insurance from AARP? No, but I do suggest looking at better offers on the market especially if you have or are considering the AARP level benefit term offering. Between the AARP term insurance and Globe Life replacements we’ve done, we know seniors complaints only too well. .

These policies all leave something to be desired. The value of ownership is just not there. Other companies easily supplant them frankly.

Wheter they are not priced competitively or are not senior burial/final expense insurance products (AARP term life insurance).

NYL has some very fine insurance products. However, those are not not available thru AARP and are not as easy to qualify for.

As you comb thru other AARP life insurance reviews, remember that the association makes an a lot of money licensing their brand name to New York Life. They are the insurance company behind the products. This is at your expense and you are not receiving a premium policy in exchange.

Is it in your best interest? I’m not seeing it.

Be careful what life insurance product you are buying. It is not always a simple apples to apples like many assume. What is written into a whole life or term life insurance contract is what you are going to get. Read your policy when you receive it. Benefits paid have nothing to do with the name of the insurance company on the policy.

We all want to buy the right policy for those we care about don’t we?

Carefully consider what you are purchasing before assuming it must be a good product because it has an AARP stamp on it.

It means nothing folks.

Is AARP your friend in your life insurance quest?

In the opinion of this independent life insurance agent and writer, no.

Is AARP Life Insurance Good?

Our official Maple Valley Insurance Group Grading:

AARP Term Life Insurance = “F”

AARP Whole Life and Guaranteed Issue Whole Life = “C”

In Conclusion, Get a Quote From Maple Valley Insurance Group

None of these AARP, NYL policies rank well among the top products for final expense insurance. Is AARP life insurance worth it? The whole life insurance products would be the only passing grades they receive from our office. We have received so many complaints regarding their term life product over the years. The term product does not meet the needs of the vast majority of seniors and should NEVER be used for end of life final expense planning. I can’t tell you how many people 50-80 I speak with that are upset with their purchase with AARP/NYL insurance products.

As part of this AARP life insurance review, we recommend you look to other insurance carriers for life insurance coverage.

Are any of the AARP life insurance products really worth it?

No. The term policy is low tier and the whole life products are not competitive. There are numerous companies that have better whole life products and pricing.

Frankly, AARP life pricing is not competitive with the top life insurance companies.

Take action now and get yourself a good independent life insurance agent/broker for starters. You will do a lot better and have all your options in front of you instead of disappointing, overpriced products from 1 company. Having choice is the key to finding the best protection for those you care about the most.

With a phone call to us, we can help you prequalify for the right policy for your needs and budget. Otherwise, take a moment and use our instant quoting tools. It will take you a minute or so, but you will see how overpriced these AARP policies are on an apples to apples basis. The company comparison will allow you to see whole life insurance pricing and level premium, term life insurance which does NOT increase in price during the entire term of the policy.

For the whole life quoting tool…unless you have a very, very serious medical situation, select “Excellent Health.” 85% of people 50-85, including seniors, pre-qualify for the best offerings from these premium carriers.

Folks, there are numerous life insurance companies that just have better products and much better rates for you. I can say that with assurance. I get those same AARP life insurance ads in the mail all the time.

Is there any reason why you believe they may be the best to protect your family? If so, please leave a comment below. We’d like to know your opinion.

Food for thought ladies and gentleman.

Don’t assume you can’t qualify for simplified, medically underwritten senior whole life insurance with full, immediate and level premiums.

All life insurance companies have different standards and medical questions used to compete with each other and earn your business. Let a professional sort this out for you.

It’s always free here and likely done in minutes of your time.

Hope this article has helped you make a good decision for yourself. Please feel free to comment below, continue exploring our site, or simply call to get your questions answered. We’re here to help. (269) 244-3420