If you are reading this article here today, I am going to assume you are wondering if AARP term life insurance rates for seniors is worth considering for insurance protection? Quick fact: AARP life insurance is provided by New York Life. The insurance company has licensed the use of the association’s name to market 3 different life insurance products to you. 2 of them are whole life insurance products, the other is term life insurance.

AARP is not an insurance company. All claims, term life insurance rates and approvals are handled by NYL.

If you know specifically how many years you need financial protection for, then an appropriate term life insurance policy may fit that bill.

Before you look at the NY Life AARP term insurance below, be sure to use our instant life insurance quote tools. In 1 minute you’ll have the top rates for true, level premium term life insurance and no exam, whole life insurance from the top life insurance companies in the industry.

As part of this review, what I am about to unveil here regarding the senior AARP term product is likely to be disappointing and potentially shocking especially if you are an AARP member! Like you, I receive mail solicitations to buy the AARP branded life insurance from New York Life.

Before you read further, be aware that if you happen to be a senior over 80 and interested in AARP life insurance you will have to find a company who offers life insurance to people over 80. AARP/NYL does not.

If this is you, give us a call for help or use our quoting tool on this page to find out all the top carriers and plans who do approve seniors over age 80. Discuss your needs with an independent life insurance agent who can help you determine what you can qualify for before buying any life insurance. Don’t get duped into the wrong policy. Apples are not apples with life insurance policies.

No Exam Term Life Insurance Rate Increases with AARP?

One of the most concerning factors of being a licensed field underwriter is seeing content on the internet not written by licensed & experienced, life insurance agents. Misinformation and misunderstanding of different policies leads to upset policy owners and/or their families. Watch out for insurance company ads as well. Many ads do not illustrate the real purpose of the policy nor the limitations built into it. The low advertised price catches the eye of a consumer, often on a fixed income who just wants some affordable life insurance they can depend on only to find out it does not purchase a good policy for their needs.

AARP sells the use or their brand name to the highest bidding insurance company. This is a profitable business relationship for the association. In recent years, New York Life has been the highest bidder and therefore approved to solicit consumers with the use of the AARP brand name applied to 3 specific policies they offer.

NY Life AARP Level Benefit Term Insurance

One feature of this term life policy is the dependable death benefit amount it offers your beneficiary till the insured’s 80th birthday.

At application, you choose how much protection you would like to apply for. With the NYL term life product, you can apply for amounts up to $150,000. During the policy term, the policy’s death benefit will never decrease, regardless of age or health… until it expires.

However, did you realize that this term life insurance from New York Life (NYL) with the AARP name stamped on it goes up in price? Yes, it is a “level benefit policy” but it also has rate increases after you purchase it. Guess AARP forget to tell New York Life that the vast majority of seniors live on a fixed income??

Knowing the limitations of any life insurance policy is critical before making your purchase. Avoid judging the policy based on the company who’s brand name is on it. The black and white written into any term or whole life insurance policy is what your family will receive…or not receive. A term life insurance policy from AARP will not last a lifetime. It is not permanent life insurance.

In working with a tremendous amount of people up to age 90 over the years, one of the largest problems we hear about are complaints related to owning certain term life insurance policies.

Why?

The monthly premium not being level for the life of the policy. In other words, going up over time.

Not all term life insurance policies have guaranteed level rates. AARP term life insurance is one of those policies. Globe Life is another company that has this practice.

Expect these partlcular term policies go up in price as you own them. The future scheduled rate increases are also not guaranteed in cost. With the exception of the first rate increase, your rate increases are every 5 years.

If you are looking for financial protection for end of life expenses for your loved ones, term life insurance is NOT that answer. Final expense whole life protection does not expire regardless of age, go up in price or reduce benefits. Term life insurance does.

Many life insurance consumers do not realize term policies have NO cash value, ever. Not that cash value is a benefit everyone needs, it is however, as stated earlier, important to understand the limitations of any life insurance policy and what your policy offers.

You see…

AARP branded or not, term insurance is temporary life insurance…you are renting it most often on a monthly premium basis for specified period of time such as 10, 20 or 30 years. With the NYL term policy, it is term to age 80.

NYL seems to have adopted a philosophy of selling no exam AARP term life insurance to seniors without offering much guidance on the policy.

If you are an association member age 50-74 you can apply for the NY Life AARP term life insurance policy. However, you will be denied application for the term life insurance product at age 75 regardless of your health. You must have been approved for this specific term life insurance policy prior to your 75th birthday.

The problems of this policy continue…

Term life insurance from AARP terminates on your 80th birthday.

In other words, when your 80th birthday arrives, place it in the garbage. There is no return of premium (ROP) or benefits paid out at this point. Selecting the wrong life insurance policy can be a financial trap in the making.

Like most modern term life insurance policies, you are allowed to convert to a whole life insurance policy prior to expiration. However, the price for the whole life conversion is based on your attained/future age. This is normal. You cannot be turned down to convert unless your are outside the conversion window built into the policy. You may request a smaller policy to lower the new cost but expect to pay a high premium. Whole life insurance with NYL is very pricey and certainly more expensive than the term insurance at 50, 60 or 70, particularily for men.

How many people do you know who have lived beyond age 80? I receive calls from many people each week who are 80+. Plenty of my clientele have lived to 90 or more.

Seniors AARP Term Rates and Benefits Are Unimpressive

Why?

For starters, the rates of AARP term life insurance for seniors goes up every 5 years, period. Second, you cannot apply for coverage after you reach the age of 75. You will have rate increases at age 55, 60, 65, 70 and 75. Unlike a level premium term policy or whole life insurance plan, the monthly premium is not locked in.

Here is the kicker to the owner or payer of this particular policy. None of the rates are guaranteed!

At the time you make application you will see the projected cost in your policy for each 5 year age block. However, once you read the fine print it is clear that NYL has the right to raise the cost of the premiums on all their term policyholders beyond what is scheduled. No written guarantees for people on a fixed income.

Why not just have a level premium for the life of the policy and with an expiration at age 80?

Ladies and gentlemen, this is not a high quality term policy. While AARP life insurance has no medical exam it does not have anything else noteworthy built into it. It will eventually become very expensive to own.

Further, it seems to have a lot of limitations for those who need larger term life insurance policies. $150,000 is a small term policy to be honest. Policies below this amount are generally for end of life expenses and those should never be funded by a term insurance policy which often expire prior to passing away leaving financial pain for the beneficiary in many cases.

Term insurance is only for a clear, defined period of time. Quick examples: a loan, a mortgage. These examples will have a defined number of years of monthly payments. A term policy is a good solution to ensure the family has money to pay off the debt during the defined period of time if the insured passes away. Term life insurance is most often deployed by young families raising kids. It cover the “what-ifs” for their family, not the inevitable.

How much coverage do you need? Do you want your premiums going up every five years… until you potentially get frustrated and drop it? New York Life certainly appreciates the endowment they receive when their AARP policyholders drop the coverage early. Does a term policy meet the needs of your family or are you leaving them at risk with expiration at age 80?

I am sure you do not intend to drop your policy if you own one, but be sure you understand the realities of the policy before buying. Those AARP term life insurance quotes will become expensive rates down the road. I have heard plenty of stories from upset people who thought they found “a good deal.”

New York Life AARP Level Benefit Term Life Insurance Quote

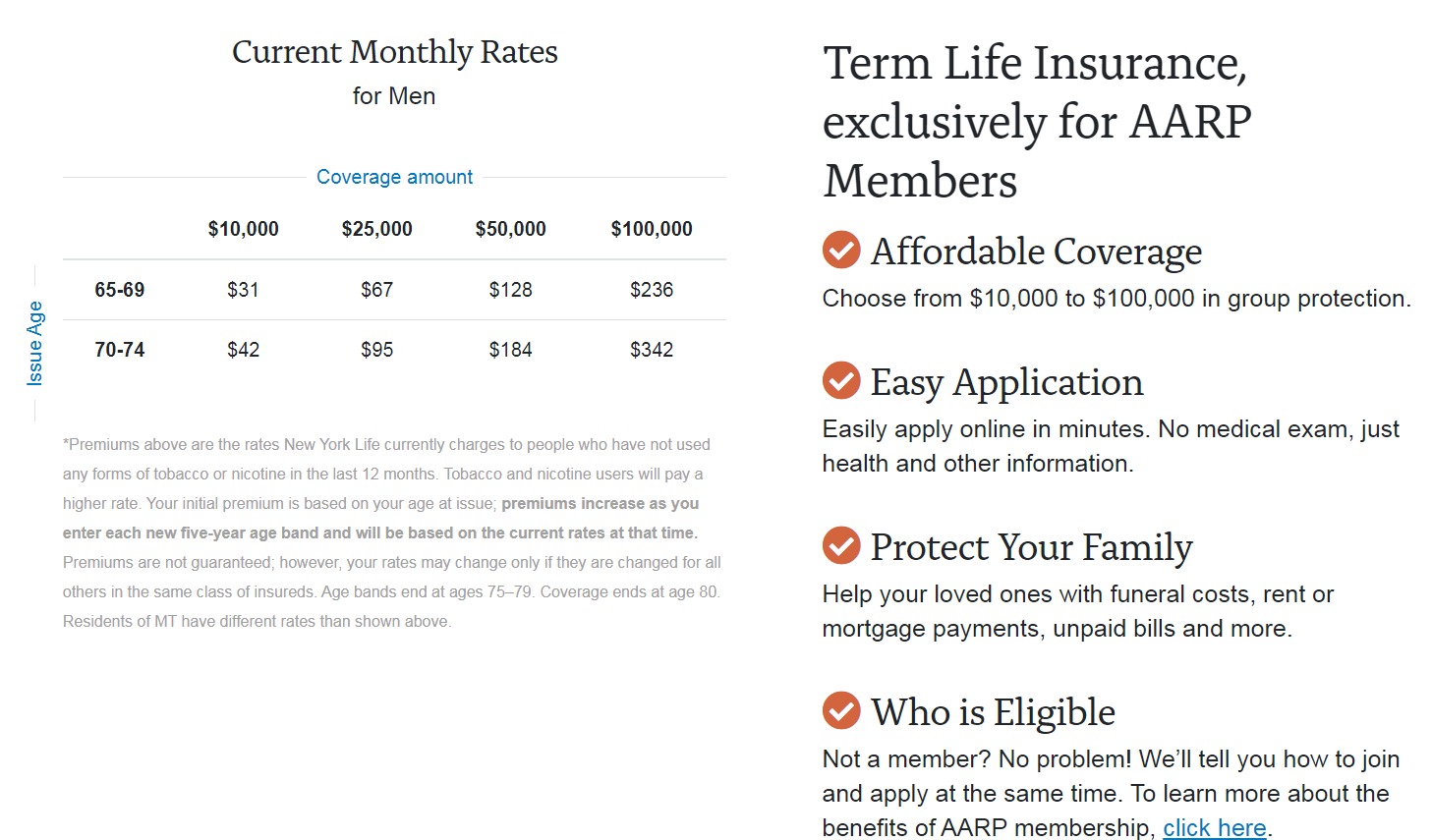

AARP term life insurance cost provided below were taken directly from the NYL/AARP website. The illustration is based on a fictitious 65 year old male, non tobacco user for term life insurance. Please be sure to carefully read the fine print below the quotation. These rates are not updated for 2025 but clearly illustrate what you are getting yourself into. Be sure to read the “fine print” below the provided rate chart.

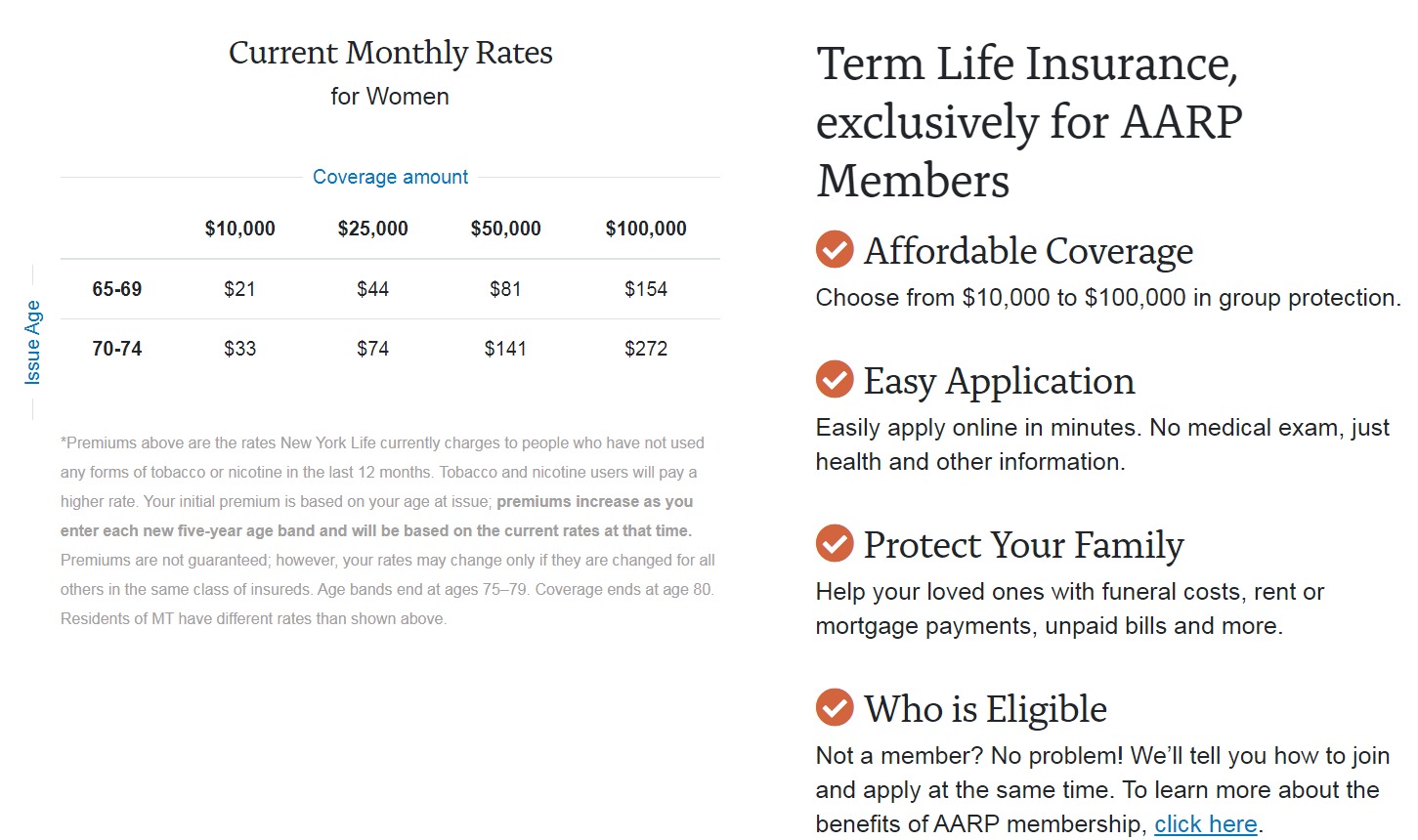

Next, we have AARP term life insurance quotes directly from the NYL/AARP website on a fictitious 65 year old female, non tobacco user for term life insurance. Please be sure to carefully read the fine print below the quotation. This is as important as the rates.

Pricing For The AARP Term Life Policy: The Real Truth

You may have noticed that there are no term life insurance rates provided by AARP/NYL for seniors age 75-79 who have this particular policy. This is also where most policyholders are “shaken out” by a very large rate increase.

So, how do I know this? Feedback from hundreds of former NYL/AARP term life insurance owners calling us looking for affordable life insurance that doesn’t keep going up in price. Same story each time. Most of the time, these folks did not read their policy when they received it and assumed it was affordable, life long coverage. Often these callers did not know that their policy expired at age 80 either. Plenty were in shock that AARP would support this product being sold to seniors at all.

Imagine your AARP term life insurance rates rising every 5 years until it becomes unaffordable or terminates. This is how this particular policy works. It is NOT a level premium term insurance policy. It is called a level benefit term insurance policy. Level benefit just indicates that the death benefit is full, first day coverage for the death benefit amount till the date of expiration, your 80th birthday.

While the AARP term life insurance quotes may be enticing from age 50-70 or so, it is not competitive with a whole life insurance policy long term. Whole Life insurance will protect your family for the the rest of your life. While you may save a few bucks early on with the AARP term insurance, the savings is quickly eroded by the time to reach age 70-75. Something else to remember, whole life insurance will be considerably more expensive at 75 than if you had bought it years earlier and “locked” a lower lifetime price.

Whole life insurance rates are always more affordable the younger you are at application. The best rates and policies will require that you answer some health history questions as well. As we age, qualifying for the best policies are going to be more difficult for seniors with health problems on top of the higher rates.

Where does this leave you and/or your family when this AARP term life policy becomes too expensive or expires because you live past your 80th birthday?

Why Shopping for Life Insurance Based on Brand Familiarity Is Not a Good Idea…

At the intial date of writing this post, I had spoken with a 69 year old man with 3 very significant health conditions. He requested a $500,000, 10 year level premium term life insurance policy to cover the remaining time on his mortgage. He wanted to protect his wife in case he had an untimely death.

Unfortunately, his 3 health conditions significantly impacted his premium. Asthma and Diabetes combined with the lingering threat of COVID-19 were not a good combination. However, I was able to get him an offer of $534 per month for the next 10 years for $500,000 of coverage with guaranteed level premiums and death benefit.

I should mention, this premium is from a very reputable, A+ financially rated (according to A.M. Best) life insurance company. That same gentleman would pay $272/mo minimum for just $100,000 at age 70 with the AARP/NYL product. Don’t forget, AARP rates go up every 5 years. This is certain. The fine print tells the truth.

The better alternatives, well….

Top life insurance carriers lock those rates in for the life of the policy term. $272 dollars would buy my new, anonymous client roughly $250,000 of 10 year term life insurance with absolutely no rate increases written into the policy. Ponder for a moment how much it would cost you for $100,000 of protection from AARP/NYL. Remember, those premiums go up significantly every 5 years to top it off!!

NYL AARP Life Insurance For Seniors Over 70

New York Life does offer 3 plans with the AARP logo to choose from. The first is their term life insurance policy. That product is the main subject of this article. However if you are 70 or over, you’d be better off exploring whole life insurance.

2 of the 3 AARP/NYL policies offered are based on whole life insurance. Yes, they are more expensive because they do not expire. Whole life insurance is designed to protect your loved ones for the remainder of your life AND the price never goes up, unlike AARP term life insurance. Their term life product becomes very expensive at age 75 and is not even available to new applicants as of age 75. Remember the term policy expires promptly on your 80th birthday.

Now, if you don’t like the high cost of the whole life insurance policies and want more competitive rates and permanent, lifetime coverage, give us a call and we will shop the market in minutes to find you the best value. That is our expertise. AARP life insurance for seniors over 70 simply does not have much value compared to the competition out there.

If you’d like, use the instant quoting tool on this page for a head start on whole life insurance for seniors over 70.

AARP Life Insurance For Seniors Over 80 Options?

If you skipped to this part of the article, you should know that you are out of luck with the New York Life AARP branded products. AARP life insurance rates for seniors over 80 are not available. Even their permanent life insurance products are not available to new applicants over age 80. You must be approved with AARP/NYL prior to your 81st birthday to qualify for a whole life policy.

What do you to solve that problem?

We’ve got all your options right under our roof, but do forget about term life insurance in your 80’s. Wrong life insurance product.

Use the instant quoting tool on this page to find a life insurance solution. It will show you the top companies and products on the market for your age. These are the life insurance companies and plans designed for those seniors 80+.

Since we help seniors over 80 obtain life insurance daily, we welcome you to simply us at 269-244-3420. We’ll get your questions answered and see what you actually pre-qualify for. This is the best way to ensure you get the right product for your needs. Remember, you don’t have to be in perfect health even if you are over age 80.

Term Life Insurance From AARP A Good Deal or Not?

While the ease of application and cost for those in their 50’s and 60’s will price out lower than a permanent, no exam whole life policy will at that same time, the equalizer will be advancing age. You cannot avoid the rate increases owning this AARP term policy. The rate increases are scheduled into it.

A point of concern: Notice they do not tell you the price at age 75. Why?? It is a duzzy. That surprise is left for you to discover later, the hard way. Unfortunately, it leave many seniors in a very tough spot due to advancing age and declining overall health.

Our AARP Term Life Insurance truthful review does not give this policy high marks.

Ladies and gentleman, if you own a AARP/New York Life policy, read it carefully! Again, apples are not apples among life insurance policies. If you are pretty healthy, 50-70 and only need term life insurance, we have you covered with no exam, level premium term life insurance. Depending on your overall health, we generally look to John Hancock, Prosperity Life, American Amicable and Foresters Financial for most cases.

NYL/AARP life insurance is not a special benefit for being a member of the association. This policy is marketed aggressively to AARP members.

Here is some insight to life insurance policies you should consider. Term Insurance is typically harder to qualify for, period. It is not designed for the average seniors health. This AARP/NYL policy has been compromised to make it profitable for NY Life and easy to qualify for.

Unfortunately, that comes with compromises.

You are going to get what you pay for. Lower benefits, and ultimately higher premiums as you age that are combined with an expiration date of your 80th birthday. If you are 50-60 and need no exam term insurance you should be looking at no exam level premium term life insurance which locks the price for the whole term! NYL term insurance with the AARP brand name is not the answer.

Don’t get the wool pulled over your eyes.

The life insurance industry as a whole does not endorse term life insurance for final expense protection. Again, it is strictly temporary life insurance, for the “what-ifs” that may happen during a defined period of your life. Seniors planning for end of life costs need guarantees that ensure their family is protected and not left in a mountain of debt if they live beyond their 80th birthday. Since most are on a fixed income, they need to know how much they will be paying each month. Term life insurance from AARP, New York Life does not meet either of these criteria.

A term life insurance product for seniors not mean it is for final expenses. Ask yourself a couple of questions. First, are you planning for end of life expenses? If not, do you just need life insurance for a specific time frame? Why are you considering this term life insurance product?

The reality…

AARP/NYL Term life insurance reflects poorly on the association for numerous reasons. Most seniors are on a fixed income and need a policy they can afford for the rest of their life. Trying to buy life insurance at 75+ can be very difficult and or expensive for those on a limited and/or fixed income. Life insurance is not like buying home or auto insurance. You have to qualify based on your age and health for the best life insurance policies.

A red flag with this term policy…the premium charge could be higher in the future than scheduled. This is in addition to the policy rate increases you, the consumer will have at age 55, 60, 65, 70 and so on.

Why?

AARP term life insurance rates are NOT guaranteed to age 80. The policy will indicate the anticipated premium going forward but no guarantee is included.

Still need their term policy?

The No Medical Exam, AARP Term Life Insurance Policy Is For A Defined Period Of Time

If you only need temporary life insurance, why not have term life insurance which guarantees your premium and coverage amount for the number of years you want? This is called level premium term life insurance.

No exam, seniors term life insurance from AARP/NYL is not level premium life insurance. Watch out for the wording in their advertisements.

In my experience, many people get caught assuming that AARP is looking out for them with these policies. This is a false reality. Remember, AARP is licensing its name to New York Life. NYL is who you are doing business with not the association. When your final day comes, your beneficiary will be dealing directly with NYL to file the claim, not AARP.

Term life insurance is always temporary life insurance. You are renting the financial protection for a period of time. It is not intended at all to cover anyone for their life. In any AARP branded term life insurance policy from NYL, it clearly states that this term policy expires on your 80th birthday.

Mentioned earlier, I get NYL/AARP life insurance info in the mail as well. The life insurance programs are subpar and/or overpriced when compared to the top life insurance products available to you. AARP has been selling their name out to different insurance companies for years. They license the AARP name to the insurance company who makes them the highest offer. It brings in a lot of money for the association.

No exam, top shelf life term insurance policies offer built in assurance including both fixed rate and death benefit guarantees for the length of term you select. They also provide guaranteed conversion options should you desire to change to a permanent, whole life insurance policy.

The AARP/NYL life insurance strategy is to mail the masses to bypass independent life insurance professionals who would advise against this type of policy for final expense planning.

Term life insurance, expiring commonly at 75 or 80, should not be used to cover final expenses. Your family could be financially devastated and unable to pay your bills. Trying to buy life insurance as you get older becomes harder as your health and age works against you.

Don’t lose site of your goals of purchasing life insurance. Picking the right policy the first time is key. Price is secondary to the correct type of life insurance for your needs and goals.

NYL, AARP Term Life Insurance Rate Trap

Don’t use term life insurance from any insurance company to plan funeral and burial expenses. Big, big mistake. Just because New York Life has a “cheap” product marked thru AARP does not mean it is a product you should consider. NYL is a fine insurance company, but this term offering is not one of their better products.

Where the trouble begins with cheap life insurance…

Life insurance consumers age 50-80 often get caught trying to look into the crystal ball only to find out the hard way that term coverage was the wrong choice.

Term life insurance is designed for the unexpected not the expected. This is another reason that term life insurance for seniors over 80 with AARP is not available.

Make sure your family does not find an expired term policy in the “file cabinet” because of a gamble you took. For many families, the cost of a funeral and burial can be more than financially devestating. How would your loved ones manage if they did not have life insurance to pay your bills? How much is a funeral and burial in your area? Getting into $15,000 for both services in 2025 is pretty standard around the US.

People planning for end of life expenses need permanent life insurance. This is called final expense whole life insurance. Whole Life insurance can guarantee protection for your family when “that day” comes.

Yes, better products like this are available thru AARP but are very expensive by comparision to the top companies and products. You are paying for the high marketing costs that NYL has to pay AARP. It is figured into your premiums with any AARP branded policy.

The last thing the family needs at a highly stressful and emotional time is an expired term life insurance policy. Every week I hear a story from someone who went thru a bad experience with a deceased family member who had an expired term policy in their family members drawer.

Do yourself a favor, with the belief that AARP life insurance for seniors is the answer, select the AARP, whole life insurance product. Yes, it is still way overpriced compared to the top final expense whole life insurance companies, but it will not expire or go up in price, ever. This is a true, final expense whole life insurance product.

If you need our help with life insurance over age 80, we can likely get you insured with a whole life policy with one of the top final expense insurance carriers.

Wrapup: AARP Term Insurance Rates and More

Looking for a great and affordable policy even in your 80’s? You will need to speak with an independent agent/broker that has access to all the insurance companies that offer life insurance to seniors even age 80 to 90. Remember, even if you bought a term policy from AARP 10 years ago, it will expire at age 80. AARP life insurance for seniors over 80 is not available ladies and gentleman.

Find a seasoned, independent professional to discuss your life insurance needs and find out what your best options for coverage are. Buying final expense whole life insurance is always a better solution when planning for the unknown day. Remember, AARP term life insurance rates seem affordable until their not.

I receive a lot of phone calls daily for final expense life insurance. No one is happy with their term policy purchased from New York Life with that little AARP stamp on it. Most folks end up buying one of our whole life plans instead. They don’t want to leave their families without guaranteed financial protection and are tired of the rate increases they receive.

Consumers of this policy whom type get a rude awakening by age 75. Most are shocked at how expensive their term insurance became. A large number of people are not even aware the policy expires at age 80. In 2020, the United States average life expectancy of a woman wass just shy of 80.

Is AARP term life insurance a “deal?”

No, it is not. Unless you only need life insurance till your 75th birthday when the rates jump into “outer space.”

Check out our no exam “final expense” quoting tool on this page. Yes, it is free and will instantly show you who has the best pricing. You’ll quickly see why working with an independent agent/broker is far superior to buying an AARP branded policy from NYL, the insurance company who offers the branded AARP term life insurance policy to consumers. All of these plans last your whole life while the cost never goes up and the benefits never go down either.

If you want the most affordable life insurance you can easily qualify for, simply give us a call. We regulary work with people 50-85 on fixed incomes many of whom are in less than perfect health. It is best if you are open about any health conditions you might have so we can identify the best company and policy for you personally.

With the agent you discuss your needs with, be sure you are clear as to what your goals are with the life insurance. He or she should also understand your purpose/intention and monthly budget. From there they can advise you on your options and what you can qualify for.

A good independent agent/broker should have access to all the top life insurance carriers with plans designed for people 50+. With your goals, age and health, an independent agent/broker can effectively shop for the best policy for you.

Whomever you select to shop your case, make sure they work with a dozen or more carriers so you can be assured you are getting a good price on the specific type of policy you can qualify for.

Don’t be drawn into a flash in the pan such as New York Life AARP term life insurance for seniors. It can really look like a “deal” until the limitations of the policy ultimately reveal themselves. The insurance company is well aware most people are going to drop the policy by age 75.

All insurance companies have different ways of evaluating their life insurance applicants.

A good professional will always be able to sort thru any and all health conditions you may have to find the right i policy for you and your loved ones.

Key here is: don’t prejudge yourself. Let someone who has the expertise sort it out.

We are here to help if you would like to discuss your situation with us and it won’t cost you even a nickel. We are the one stop source for all the top carriers and their products for people age up to age 90. Phone: 269-244-3420

If you have any comments as to why this New York Life policy and rates for the AARP term life insurance might be of good value, be sure to leave your thoughts in the comments below. We enjoy and appreciate the feedback.